Read on to learn more about Credit Union 1 promotions, bonuses and offers here.

You can now take advantage of a $100, $500, $1,000 bonus when you open a new account and meet all the requirements.

About Credit Union 1 Promotions

Credit Union 1 serves over 89,000 members throughout Illinois, Indiana and Nevada. Headquartered in Rantoul, IL, Credit Union 1 had grown into a billion dollar plus financial institution, keeping their core values the same. Be Great, Be Engaged, Be Open, and Be Nice.

Easy Membership: You can apply for membership under the Credit Union 1 Educational Development Association (CU1EDA) for a $5 donation which will be contributing to the benefit of continuing education for selected groups.

I’ll review the Credit Union 1 Promotions below.

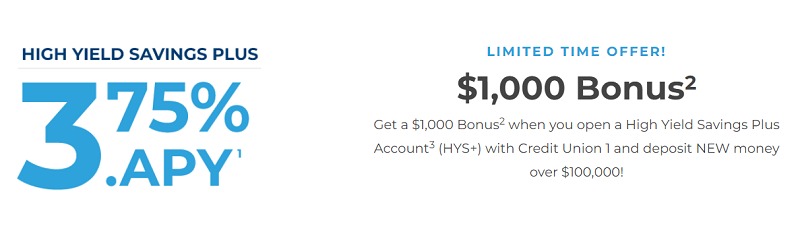

Credit Union 1 $1,000 Savings Bonus

Credit Union 1 is offering a $1000 bonus when you open a new qualifying savings account.

- What you’ll get: $1000 bonus

- Account Type: Savings

- Availability: Nationwide via $5 membership. Branches in IL

- Direct Deposit Requirement: No

- Credit Inquiry: Soft Pull

- ChexSystem: Yes

- Credit Card Funding: None

- Monthly Fees: None

- Early Account Termination Fee: Bonus deducted if closed within 12 months

- Household Limit: None listed

(Limited Time Offer)

| AlumniFi Credit Union Savings (4.75% APY) | SoFi Checking & Savings ($325 Bonus + 3.80% APY) |

| Upgrade Premier Savings (4.15% APY) | Discover® Bank Savings (Up to $200 Bonus + 3.70% APY) |

| CIT Bank Platinum Savings (4.00% APY) | Harborstone Credit Union Money Market (4.30% APY) |

| FVCbank Advantage Direct Savings (4.55% APY) | Live Oak Bank Savings (4.10% APY) |

How To Earn Bonus

- Get a $1,000 Bonus when you open a High Yield Savings Plus Account (HYS+) with Credit Union 1 and deposit NEW money over $100,000!

- This is a limited time offer available only from 1.17.23 to 3.15.23 and cannot be combined with any other offers.

- The $1,000 bonus (Bonus) will be deposited into your CU1 High Yield Savings Plus (HYS+) account at the end of the business day on the day you open the HYS+ account by making a minimum $100,000 deposit balance of new money from a competitor financial institution to earn dividends.

- The $1,000 bonus will start earning interest immediately but not be eligible for withdrawal until the account has a balance of $100,000 or greater for twelve (12) consecutive calendar months from the date of opening of the HYS+ account.

- Bonus is considered interest and will be reported on 1099-INT.

- Offer may be cancelled at any time without notice.

- Account Closure: If the HYS+ account is closed by the member or Credit Union1 or balance drops below $100,000 within 12 months after opening,

- Credit Union1 will deduct the Bonus from the HYS+ account at closing.

Credit Union 1 $500 Checking Bonus

Credit Union 1 is offering a $500 bonus when you open a new qualifying checking account with promo code CHK500

- What you’ll get: $500 bonus

- Account Type: Checking Account

- Availability: Nationwide via $5 membership. Branches in IL (Bank Locator)

- Direct Deposit Requirement: Yes, $1,000+ per month for 3 months (see what works)

- Credit Inquiry: Soft Pull

- ChexSystem: Yes

- Credit Card Funding: None

- Monthly Fees: None

- Early Account Termination Fee: Bonus deducted if closed within 12 months

- Household Limit: None listed

(Expires 07/31/2023)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- Open a CU1 Checking Account using promo code CHK500

- Establish direct deposit activity within 90 days of account opening or by July 31st, 2023 of $1,000 per month.

- The $500 bonus will be deposited into your account following three (3) consecutive months of qualifying activity.

- To redeem this offer you must use Promo Code: CHK500 before July 31, 2023.

- Offer not available to existing members who already have direct deposit coming into a CU1 account, those whose accounts have been closed within 90 days, or closed with a negative balance within the last 3 years from the date of use of the Promo Code.

- Promo Code is only good for one-time use and is not redeemable with any other offers.

- To receive $500 bonus: (1) Within 90 days of use of the Promo Code, you must establish a recurring direct deposit into a new or existing CU1 checking account and the recurring direct deposit must result in a minimum aggregate total direct deposit of $1,000 per month being received into the new or existing CU1 checking account for three consecutive months beginning on the date of the use of the Promo Code. (2) The three consecutive months must be accomplished before the expiration of one-hundred eighty days from the date of use of the Promo Code. (3) Your direct deposit must be from an electronic deposit of your paycheck, investment account, pension or government benefits (such as Social Security) distribution from your employer or government agency.

- Person to Person transfers or payments and wire transfers or any other non-recurring electronic deposit are not considered a recurring direct deposit.

- Bonus will be paid by deposit into your CU1 checking account within 30 days of meeting all qualifying criteria.

- To receive the bonus, the checking account must not be closed or restricted at the time of payout.

- Bonus is considered interest and will be reported on 1099-INT.

- This offer may be cancelled or amended at any time without notice.

- Account Closure: If the checking account is closed by the member or by CU1 within 12 months after opening, we will deduct the bonus amount from the checking account at closing.

Credit Union 1 $500 CD Bonus

Credit Union 1 is offering a $500 bonus when you open a new qualifying CD account.

- What you’ll get: $500 bonus

- Account Type: CD

- Availability: Nationwide via $5 membership. Branches in IL

- Direct Deposit Requirement: No

- Credit Inquiry: Soft Pull

- ChexSystem: Unknown

- Credit Card Funding: None

- Monthly Fees: None

- Early Account Termination Fee: Bonus deducted if closed prior to maturity

- Household Limit: None listed

(Limited time offer)

| Western Alliance Bank 3-Month CD (4.50% APY) | Western Alliance Bank 12-Month CD (4.25% APY) |

| Ponce Bank 3-Month CD (4.25% APY) | Blue Federal Credit Union 9-Month No Penalty CD (3.75% APY) |

| Sun Canyon Bank 11-Month CD (3.98% APY) | Ponce Bank 4-Month No-Penalty CD (4.15% APY) |

| Quontic Bank CD (Up to 4.25% APY) | |

How To Earn Bonus

- Get an up to $500 Bonus2 when you open a 44-Month Share Certificate. There is a $1,000 minimum balance requirement to open the Share Certificate, and you can receive a bonus payment2 when you deposit NEW money over $100,000!

- $100,000 – $249,999 deposited | $250 one-time Bonus Payment

- $250,000 and over deposited | $500 one-time Bonus Payment

- To be eligible to open the Special 44-Month Share Certificate and receive the one-time Bonus Payment, you must meet the following eligibility criteria:

- Less than $99,999 deposited| Not Eligible for Bonus Payment.

- $100,000 – $249,999 deposited | $250 one-time Bonus Payment.

- $250,000 and over deposited| $500 one-time Bonus Payment.

- Must be opened with “New Money”. “New Money” is defined as money not on deposit with Credit Union 1 within the last 12 months and transferred in from a different financial institution – no Credit Union 1 to Credit Union 1 balance transfers allowed at any time. Money withdrawn from Credit Union 1, then redeposited within a 12-month period from the date of withdrawal will not qualify as “New Money”.

- All accounts you have with Credit Union 1 must be in good standing at the time the Special 44-Month Share Certificate with one-time Bonus Payment is opened.

- Limitations: You are limited to receive only one (1) Bonus Payment no matter how many Special 44-Month Share Certificates you open. The one-time Bonus Payment will be paid by deposit into your CU1 Primary Savings account within 30 days of meeting all the eligibility criteria. The one-time Bonus Payment is considered interest and will be reported on a 1099-INT. The Special 44-Month Share Certificate with one-time Bonus Payment offering may be cancelled at any time without notice.

- Account Closure: If the Special 44-Month Share Certificate with one-time Bonus Payment is closed by the member or by the credit union before the maturity date, there is an early withdrawal penalty and the one-time Bonus Payment shall be forfeited. At early the withdrawal/termination, the credit union will deduct the early withdrawal penalty and the one-time Bonus Payment amount, which may reduce the amount of principal you receive at that time. We may impose a penalty if you withdraw funds from your account before the maturity date. The early withdrawal penalty for the 44-month share certificate is 270 days’ dividends as well as the Bonus Payment amount, if any.

Credit Union 1 $100 Student Checking Bonus

Credit Union 1 is offering a $100 bonus when you open a new qualifying checking account.

- What you’ll get: $100 bonus

- Account Type: Student Checking Account

- Availability: Nationwide via $5 membership. Branches in IL

- Direct Deposit Requirement: No

- Credit Inquiry: Soft Pull

- ChexSystem: Unknown

- Credit Card Funding: None

- Monthly Fees: None

- Early Account Termination Fee: Bonus deducted if closed within 12 months

- Household Limit: None listed

(Limited time offer)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- Open a CU1 Checking Account. Open a checking account with CU1 online and use Promo Code CHK100, at your local branch or by calling us today! Call our team to mention the “$100 checking offer”.

- Download and Login to Mobile Banking. Login to online banking or the mobile app within 14 days of account opening.

- Receive your $100 checking bonus. The $100 bonus will be deposited into your account once you’ve logged into online banking.

- To redeem this offer you must use Promo Code: CHK100.

- Offer not available to existing members, or former CU1 accounts that have been closed within 90 days, or closed accounts with a negative balance within the last 3 years from the date of use of the Promo Code.

- Promo Code is only good for one-time use and is not redeemable with any other offers.

- To receive the $100 bonus: (1) New CU1 Membership with checking account must be established at the time of use of Promo Code. (2) Within 14 days of use of the Promo Code, you must login to CU1 Digital Banking.

- Bonus will be paid by deposit into your CU1 checking account within 7 days of meeting all qualifying criteria.

- To receive the bonus, the checking account must not be closed or restricted at the time of payout.

- Bonus is considered interest and will be reported on 1099-INT.

- Offer may be cancelled at any time without notice.

- Account Closure: If the checking account is closed by the member or by CU1 within 12 months after opening, we will deduct the bonus amount from the checking account at closing.

How To Waive Monthly Fees

- Free Checking: None

- Free Student Checking Account: None

- Plus Checking Account: $9.95 monthly fee, waivable with $500 minimum average daily balance

- Premium Plus Checking Account: $25 monthly fee, waivable with $50,000 aggregate minimum relationship balance

|

|

Bottom Line

Lastly, Credit Union 1 has a wide variety of accounts for you to take advantage of. However, if you are not interested, be sure to check out our list of bank promotions! Additionally, definitely provide your feedback as they make our site even better!

However, Credit Union 1 doesn’t have great rates for CDs and Savings. You may want to check out our full list of Bank Rates and CD Rates.

*Compare the latest Credit Union 1 Promotions to other bank bonuses from Citi, Huntington, HSBC, Chase, TD, Discover Bank, Aspiration, Axos Bank, PNC Bank, BMO Harris, SoFi, Fifth Third Bank, Bank of America, Wells Fargo, US Bank, and more!*

Furthermore, check back at this page for Credit Union 1 promotions, bonuses and offers.