Take advantage of Chase College Checking bonus, coupon, promotions and offers here. Get your Chase Coupon to apply here!

If you are a college student 17 to 24 years old with proof of student status, you can now open a Chase College CheckingSM in-branch and qualify for a $125 bonus.

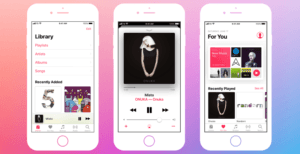

The Chase Student Checking account comes with free Chase Debit Card, free Online Banking and Online Bill Pay, free Mobile Banking, free Account Alerts, and free access to Chase ATMs and branches plus many more.

Update 7/3/25: The offer has increased to a $125 bonus (previously $100) valid through 10/15/25. If you’re a student, you don’t have to worry about monthly service fees while in school up to the expected graduation date provided at account opening (five years maximum) for students 17-24 years old. Earn a $125 bonus when you sign up and meet the simple requirements.

Chase College CheckingSM $125 Bonus

Simply click on the promotional button below and input your email to receive the coupon code for your Chase College Checking bonus coupon – then take it in branch to open your account.

- What you’ll get: $125 bonus

- Account Type: Chase College CheckingSM

- Availability: Nationwide

- Credit Inquiry: Soft Pull

- Opening Deposit: $0

- Direct Deposit Requirement: No

- Monthly Fee: $12 monthly service fee.

- $0 Monthly Service Fee for students 17 to 24 years old at account opening, enrolled in college or a vocational, technical or trade school, up to the graduation date provided at account opening (five years maximum) or $12 Monthly Service Fee

- The Monthly Service Fee after expected graduation date is $12 or $0 when you do at least one of the following each statement period:

- Option #1: Have electronic deposits made into this account totaling $500 or more, such as payments from payroll providers or government benefit providers, by using (i) the ACH network, (ii) the Real Time Payment or FedNowSM network, or (iii) third party services that facilitate payment to your debit card using the Visa® or Mastercard® network; OR,

- Option #2: Keep an average ending day balance of $1,500 or more in your checking account.

- Closing Account Fee: If the checking account is closed by the customer or Chase within six months after coupon enrollment, we will deduct the bonus amount at closing.

(Expires 10/15/2025)

How To Earn Bonus

- Students can enter your email to receive a Chase College CheckingSM coupon and visit a Chase branch to open a Chase College CheckingSM account.

- New Chase customers must be 17 – 24 years old to open a Chase College CheckingSM account and must provide a valid student ID or proof of enrollment/acceptance, college name, and expected graduation date at account opening.

- Deposit $0 or more at account opening, and complete 10 qualifying transactions within 60 days of account opening.

- After you have completed all the above requirements and the 10 qualifying transactions have posted to your account, Chase will deposit the bonus in your new account within 15 business days.

Account Features

- Enjoy $125 as a new Chase checking customer when you open a Chase College CheckingSM account and complete 10 qualifying transactions within 60 days of coupon enrollment.

- $0 Monthly Service Fee while in school up to the expected graduation date provided at account opening (five years maximum) for students 17-24 years old.

- Wire funds internationally using the Chase Mobile® app or chase.com. Send money to recipients around the world with multiple currency options. Fees apply.

- Keep track of your money with confidence and control in the Chase Mobile® app. The Chase Mobile app helps you bank securely and conveniently from anywhere.

- With Zelle®, you can send and receive money with people and businesses you know and trust who have an eligible account at a participating U.S. bank.

- With Fraud Monitoring, Chase may notify you of unusual debit card purchases and with Zero Liability Protection you won’t be held responsible for unauthorized debit card purchases when reported promptly.

- JPMorgan Chase Bank, N.A. Member FDIC

*With Chase Overdraft AssistSM, we won’t charge an Overdraft Fee if you’re overdrawn by $50 or less at the end of the business day OR if you’re overdrawn by more than $50 and you bring your account balance to overdrawn by $50 or less at the end of the next business day (you have until 11 PM ET (8 PM PT) to make a deposit or transfer). Chase Overdraft Assist does not require enrollment and comes with eligible Chase checking accounts.

Fine Print

- Offer not available to existing Chase checking customers, those whose accounts have been closed within 90 days or closed with a negative balance within the last 3 years.

- You can receive only one new checking account opening related bonus every two years from the last coupon enrollment date and only one bonus per account.

- Coupon is good for one-time use.

- To receive this bonus, the enrolled account must not be closed or restricted at the time of payout.

- Eligibility may be limited based on account ownership.

- Qualifying transactions include: debit card purchases, online bill payments, Chase QuickDepositSM, Zelle®, or ACH credits.

- Bonus is considered interest and will be reported on IRS Form 1099-INT (or Form 1042-S, if applicable).

Chase College Checking Benefits

- Thousands of ATMs & branches: Access to Chase ATMs and branches so you’re sure to find one near you.

- Send money to your friends: Send and receive money in moments with practically anyone using Chase QuickPay with Zelle®.

- Banking at your fingertips: Download the Chase Mobile® app Footnote to check your balance on your mobile device, and sign up for customized text alerts Footnote to see when your balance reaches certain limits.

- Zero Liability Protection: You won’t pay for unauthorized card transactions if you notify Chase promptly (see your account agreement for limitations and details).

- 24/7 Customer Service: Help is available online or by phone anytime, or in one of their branches during banking hours.

- Save at ATMs: Use your Chase debit card at any bank’s ATM and Chase will waive the fee and reimburse their fee for up to 5 transactions per month.

- Online Banking and Bill Pay: Pay bills and transfer money in minutes virtually whenever and wherever you like.

- Account Alerts: Use phone alerts to control your finances, keep your accounts safe, and help avoid overdrafts.

- Chase Debit Card: Access cash at over 16,000 ATMs and make purchases anywhere that accepts Visa debit cards.

Bottom Line

Overall, the Chase Student Checking is a great account to consider for all the college students out there.

Request your bonus coupon now and open your Chase College CheckingSM account at your nearest Chase branch today.

Let us know your thoughts and experience with this bonus by commenting below.

Also, don’t forget to check out all the latest credit card offers from Chase Bank and coupons for banking offers from Chase Bank on our exclusive list!

You can also view our list of the best student checking accounts and the latest bank bonuses.

Visit us often for updated Chase College Checking bonuses, promotions, and offers!

• Enjoy $125 as a new Chase checking customer when you open a Chase College CheckingSM account and complete 10 qualifying transactions within 60 days of coupon enrollment. • $0 Monthly Service Fee while in school up to the expected graduation date provided at account opening (five years maximum) for students 17-24 years old. • Wire funds internationally using the Chase Mobile® app or chase.com. Send money to recipients around the world with multiple currency options. Fees apply. • Keep track of your money with confidence and control in the Chase Mobile® app. The Chase Mobile app helps you bank securely and conveniently from anywhere. • With Zelle®, you can send and receive money with people and businesses you know and trust who have an eligible account at a participating U.S. bank. • With Fraud Monitoring, Chase may notify you of unusual debit card purchases and with Zero Liability Protection you won't be held responsible for unauthorized debit card purchases when reported promptly. • JPMorgan Chase Bank, N.A. Member FDIC *With Chase Overdraft AssistSM, we won’t charge an Overdraft Fee if you’re overdrawn by $50 or less at the end of the business day OR if you’re overdrawn by more than $50 and you bring your account balance to overdrawn by $50 or less at the end of the next business day (you have until 11 PM ET (8 PM PT) to make a deposit or transfer). Chase Overdraft Assist does not require enrollment and comes with eligible Chase checking accounts. |

Opinions expressed here are author’s alone, not those of any bank, credit card issuer, airlines or hotel chain.