Here you can find all the latest BB&T Bank promotions, bonuses, and offers. Suntrust Bank and BB&T are now Truist.

Here you can find all the latest BB&T Bank promotions, bonuses, and offers. Suntrust Bank and BB&T are now Truist.

Currently, BB&T is offering a $200 up to $1,000 bonus when you open a checking and savings account and meet all the requirements.

About BB&T Bank Promotions

BB&T opened its doors in 1872 and has since grown to over 2,000 branches. Once you join, you will have access to various accounts to protect your money. If you would like, please compare their rates with our list of Best Savings Rates and CD Rates.

- Availability: AL, DC, FL, GA, IN, KY, MD, NC, OH, SC, TN, TX, VA, WV (Bank Locator)

- Routing Number: Full list here

- Customer Service: 1 (800) 226-5228

When you open an account at BB&T it will not affect your credit score. Banks that will not affect your credit score should be considered more worthwhile of your time. For a full list of offers that will not affect your credit score check out our list of Best Soft Pull Bank Promotions.

Compare BB&T Bank Promotions with other bank bonuses from banks like Citi, Huntington, HSBC, Chase, TD, Discover Bank, Aspiration, Axos Bank, PNC Bank, Bank of America, Wells Fargo, and more!

If you’d like to participate in our Rewards Program, simply contact us when you find a new bank promotion and get paid up to $10!

I’ll review the BB&T Bank Promotions below.

BB&T Bank $500 Checking Bonus

Earn up to $500 bonus when you open a checking & savings account

BB&T Bank is offering up to $500 bonus when you open a new checking and savings account and meet the eligible requirements. Use promo code BCZGK.

- Account Type: Checking Account

- Availability: AL, DC, FL, GA, IN, KY, MD, NC, OH, , SC, TN, TX, VA, WV

- Direct Deposit Requirement: Yes, two direct deposits of $500+

- Hard/Soft Pull: Soft Pull (However, they are persistent about overdraft)

- ChexSystem: Yes

- Credit Card Funding: Up to $1,000 (Says debit card only, but credit cards will work)

- Monthly Fee: $12; avoidable

- Early account termination fee: None

- Household limit: 1

(Offer expired June 30, 2021)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | |

How To Earn Up to $500 Bonus

- In order to earn the bonus, you must:

- Use promo code BCZGK

- Complete at least (2) qualifying Direct Deposits totaling $500 or more into the new checking account within 90 days of account opening, and

- Deposit $15,000 or more into the new savings or MMA within 30 days of account opening, and maintain $15,000 or more through 90 days after account opening.

- No-fee money orders, official checks, and other banking services

- Bonus rates on CDs and IRAs Disclosure

- Two overdraft protection transfer fees waived per month Disclosure

- No BB&T fees for four non-BB&T ATM transactions per statement cycle Disclosure

- Mobile Check Deposit

- Zelle®

- eBills

- BB&T Bright Banking checking account:

- $12 monthly fee, this is waived if you do either of the following:

- Receive a direct deposit of $500 or more

- Have an average daily balance of $1,500 or more

- $12 monthly fee, this is waived if you do either of the following:

- Accounts must be opened on the same day and with the same account ownership to be eligible for the reward. The reward will be deposited into the new checking account within four weeks of verifying all qualification requirements.

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

BB&T Bank $200 Checking Bonus

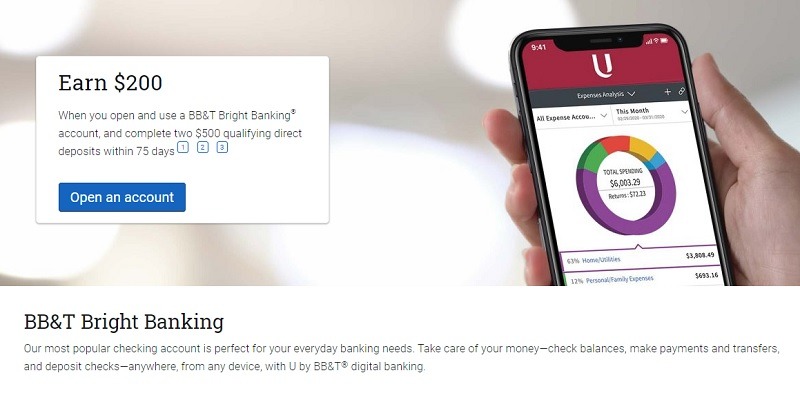

Earn a $200 bonus with BB&T!

BB&T is offering a $200 bonus when you open a Bright Banking Account and meet all the requirements.

- Account Type: Bright Banking Checking

- Availability: AL, DC, FL, GA, IN, KY, MD, NC, OH, , SC, TN, TX, VA, WV

- Direct Deposit Requirement: Yes, two direct deposits of $500+

- Hard/Soft Pull: Soft Pull (However, they are persistent about overdraft)

- ChexSystem: Yes

- Credit Card Funding: Up to $250 (Says debit card only, but credit cards will work)

- Monthly Fee: $12; avoidable

- Early account termination fee: None

- Household limit: 1

(Expires June 30, 2021)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn $200 Checking Bonus

- Open and use a BB&T Bright Banking® account using promo code BCPFZ

- Complete two $500 qualifying direct deposits within 75 days

- No-fee money orders, official checks, and other banking services

- Bonus rates on CDs and IRAs Disclosure

- Two overdraft protection transfer fees waived per month Disclosure

- No BB&T fees for four non-BB&T ATM transactions per statement cycle Disclosure

- Mobile Check Deposit

- Zelle®

- eBills

- BB&T Bright Banking checking account:

- $12 monthly fee, this is waived if you do either of the following:

- Receive a direct deposit of $500 or more

- Have an average daily balance of $1,500 or more

- $12 monthly fee, this is waived if you do either of the following:

- Valid for new BB&T Bright Banking® accounts.

- Must open online at BBT.com or in the U by BB&T app.

- Payout limited to one per household.

- Not available if the household closed a BB&T personal checking account in the last 12 months or has an active account.

- The primary account holder must be 18+ years old at the time of account opening.

- Applications subject to credit history review and approval.

- Truist employees not eligible. Not available in NJ/PA.

- A minimum opening balance of $50 is required.

- Account eligibility review occurs once, 76–90 days after account opening. Any account not in good standing closed, or with a balance less than or equal to zero at the time, we review account eligibility will not receive the $200 incentive.

- BBRFZ must be entered at the account opening. BB&T reserves the right in its sole discretion to limit the number of promo code uses.

(Expired) BB&T Bank $1,000 Checking & Savings Bonus

Earn up to $1,000 bonus when you open a checking & savings account

BB&T Bank is offering up to $1,000 bonus when you open a new checking and savings account and meet the eligible requirements. Use promo code BCNGJ.

- Account Type: Checking & Savings Account

- Availability: AL, DC, FL, GA, IN, KY, MD, NC, OH, , SC, TN, TX, VA, WV

- Direct Deposit Requirement: Yes, two direct deposits of $500+

- Hard/Soft Pull: Soft Pull (However, they are persistent about overdraft)

- ChexSystem: Yes

- Credit Card Funding: Up to $250 (Says debit card only, but credit cards will work)

- Monthly Fee: $12; avoidable

- Early account termination fee: None

- Household limit: 1

(Offer expired March 31, 2021)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | |

How To Earn Up to $1,000 Bonus

- Earn up to $1,000 when you complete the following:

- Open a checking account and complete qualifying direct deposits totaling at least $500 within 90 days of account opening

- Open any new BB&T savings or MMA, and deposit the balances below within 30 days and maintain for 90 days after account opening. Amount you deposit and maintain determines the bonus you receive:

- Less than $10,000 = $300

- $10,000 – $24,999.99 = $400

- $25,000 – $49,999.99 = $600

- $50,000 -$99,999.99 = $800

- $100,000 or more = $1,000

- Make sure to use promo code BCNGJ upon application

- No-fee money orders, official checks, and other banking services

- Bonus rates on CDs and IRAs Disclosure

- Two overdraft protection transfer fees waived per month Disclosure

- No BB&T fees for four non-BB&T ATM transactions per statement cycle Disclosure

- Mobile Check Deposit

- Zelle®

- eBills

- BB&T Bright Banking checking account:

- $12 monthly fee, this is waived if you do either of the following:

- Receive a direct deposit of $500 or more

- Have an average daily balance of $1,500 or more

- $12 monthly fee, this is waived if you do either of the following:

- All bank account bonuses are treated as income/interest and as such you have to pay taxes on them

|

|

Bottom Line

BB&T Bank promotions like the $200 bonus have a lot to like. For instance, they offer a way to avoid having to set-up a direct deposit to earn the bonus. Additionally, BB&T will not affect your credit score and they offer accounts that can earn dividends when you meet all the requirements.

If you have experience banking with BB&T, let us know how it went. Also, feel free to leave a comment below with any information we may have left out.

BB&T will pay the cash bonus (up to $1,000) once all of the requirements are met????? I did open the account in Feb, 2021 and hopefully, I will receive cash bonus by now (7 months later) I haven’t received a cash bonus. I called them several times. The bank teller was very nice and told me that she would send an email to a bank and will let me know. One week later, I still haven’t received a phone call or an explanation… Just wonder if BB&T just want people to put in the bank but not keep their promise. Should I keep a money there or move it to a different bank.

Any suggestions?

Is promotion still going on? I am thinking to open an account. Would need promotion code also!

No mention is made about when BB&T will pay the cash bonus (up to $1,000) once all of the requirements are met.

?????? Regarding the $500 BB&T Bonus for opening a checking & savings account… on this page there is a blue button that says “About BB&T $500 Bonus”, & right below it in parenthesis it says (Expired 6/30/2021).

Yes, with a ‘d’, and today is only 6/9/21. Also, when I put “bb&t promo” in the search box on your website, it said found nothing. So is the $500 Promo Bonus for opening the checking & savings w/$500 in in direct deposits & keeping 15K in Savings, still valid??? And is the Promo Code still: BCZGK ??

Anthony: Was anyone ever able to indemnify the best place to get the terms?

I’ve the same problem with the bb&t offer!

Where can I find the full terms and conditions for this BB&T offer?

I have looked on BB&T’s website. No luck.

I have message BB&T on Facebook. No luck.

I have called BB&T. No luck.

I want to read the terms and conditions before I sign up for the promotion.

11/4 I clearly qualified and opened the BB&T Bright Banking for the $200 bonus. That same day I set up my online banking and deposited a $50 check remotely. All accepted and verified. On Nov. 12 I received a mailed notice that my account was closed and BB&T has the right to close an account “with or without cause”. Phoned and was told I could only get the $50 back by going into a branch which I did. The platform person told me she would look into it and spent these past weeks, up until today, 12/7, getting answers, getting this new closed account reopened, and verifying I would receive the $200. She has kept records and gave me a copy and will follow through making sure the account is not shut down again. If it wasn’t for her, I would never have considered reopening this account. I again had to go to the branch today by appointment, but the same employee took care of everything. I was told the reason for the closed account: my email was used by others whatever that is supposed to mean. I do have gmails attached to that same gmail none of which have ever been pwned.

Went to the local bank in Westly Chapel Fl. Was ready to write them a check for $35,000 until I saw the fine print stating they have up to 90 days after the 75 days to pay you the $600. So in reality it can be a 6 months wait. Beware. Dave from Tampa Fl

As of January 22, 2020 offer is still available per customer service 1-800 226-5228.

Last July I opened the $300 bonus checking account. It had no direct deposit required. Only $1500 to avoid monthly fees and three bill pay requirements of $30 minimum each. Those accomplished immediately and $300 bonus deposited right at ninety days. Just Closed the account this week after six months to avoid penalty. Branch manager informed of the $600 current new account bonus but sadly will have to wait 12 months to be eligible for any future bonus. He inferred he could provide offer code in branch if I had any friends/family wishing to open new accounts. Marking the calendar…. had very good service the few times I entered the branch. On a side note opened one at iberia bank at the same time for $400’with DD requirement and received both bonuses the same week I was headed to Hawaii for free on points so made an all round great week…

Same experience. Really annoying because I am a new customer and would meet their criteria. Oh well

Went to a BB&T branch to inquire about the $600 Checking bonus.

They confirmed that it is currently a valid offer, but they could not offer me a (targeted) invitation or a code or an enrollment in the offer.

If you’re not on their special list, you’re just not on their special list!

Take your $ elsewhere.

Deposit $35,000 within 30 days of account opening and maintain the minimum balance of $35,000 for 7 days OR

* IT’S 75 DAYS — NOT 7

Looks like either the link is down, or BB&T has withdrawn the offer. I telephoned them and they indicate that code AVMFZ is still valid, but they do not have details on the offer (I would need to contact their new accounts department, which is closed on weekends).

I opened an account in February and have deposited over 2,000 dollars since and haven’t received a dime

I had the same issue where it told me I had to go in. I printed out the offer ($400) and went to the bank. She wasn’t familiar with it but made a call and determined that it was indeed an offer. I deposited $10,000 and she waived the fee for 3 months. Its due in another month and when the $400 shows up I will withdraw all funds and close the account. There is an early withdrawal fee (I think $35) but I can handle that. It looks like the $400 offer is not running right now.

the branch in Nashville had a drop down menu for all the bonuses. although I didn’t qualify for the targeted 450 they found one for 300 (business account). The personal 200 bonus was entered online and I received the account number and made an ach deposit – 10 days later I received a letter saying they would close the account.

They said there have been lots of attempts from people to open online accounts using other peoples ids. I went to a branch and they made some calls and everything was straightened out.

the same question, if not targeted, only use the code can i get the bonus?

Anthony or whoever tried this

I see the code but i’m not targeted. Can i still get the bonus?

The BB&T offer for $150 does not work. Their branch managers are also clueless. Tried several times, but it takes all the information and then does not open any account. It says “for security reasons, please visit branch” and as I said the branches are clueless.