Keep reading to learn more about Newtown Savings Bank promotions, bonuses, and offers.

Update 7/11/25: The business checking bonus offer has been extended through 8/30/25.

About Newtown Savings Bank Promotions

For over 160 years, Newtown Savings Bank has been operating as an independent community bank to provide financial products to help people. They have consistently lived up to their mission of serving the community.

I’ll review the Newtown Savings Bank Promotions below.

Newtown Savings Bank $300 Business Checking Bonus

Newtown Savings Bank is offering a chance to earn up to a $300 bonus when you open a business checking account and meet all the requirements.

- What you’ll get: $300 bonus

- Account Type: Business Checking

- Availability: CT

- Direct Deposit Requirement: No (see what works)

- Credit Inquiry: Soft Pull

- ChexSystems: Yes, sensitive

- Credit Card Funding: Fund up to $25

- Monthly Fees: $10-$15; waivable

- Early Account Termination Fee: 90 days, bonus forfeit

- Household Limit: One

(Expires 08/30/2025)

Editor’s Note: Here’s an alternative link to the offer.

| Chase Business Checking ($300 or $500 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| Axos Business Premium Savings ($375 Bonus) | Axos Bank Basic Business Checking ($400 Bonus) |

| Axos Bank Business Interest Checking ($400 Bonus) | Huntington Unlimited Plus Business Checking ($1,000 Bonus) |

| Huntington Unlimited Business Checking ($400 Bonus) | Bluevine Business Checking ($300 Bonus) |

| U.S. Bank Business Checking ( $500 or $900 Bonus) | |

How To Earn Bonus

- Offer is available for a new Cornerstone Business Checking account opened from June 16, 2025 through August 30, 2025.

- To earn the $500 bonus, you must open the account with $1,500 (or more) and maintain the $1,500 balance daily for period of 90 days.

- The bonus will be credited to your Cornerstone Business Checking account by 12/1/2025.

- Promo Code: BIZSUMMER25

- Offer is available for a new Cornerstone Business Checking account opened from June 16, 2025 through August 30, 2025.

- To be eligible for this offer, the business must not have had an opened Newtown Savings Bank business checking account within a 12-month period.

- To earn the $500 bonus, you must open the account with $1,500 (or more) and maintain the $1,500 balance daily for period of 90 days.

- The bonus will be credited to your Cornerstone Business Checking account by 12/1/2025.

- If your account balance is negative on or prior to 12/1/2025, the bonus will not be paid.

- Estate and political campaign accounts are not eligible for this offer.

- The required minimum balance to waive the $10 monthly maintenance fee for Cornerstone Business Checking is $1,000 minimum daily balance.

- All account applications are subject to approval.

- Your account will not qualify for the bonus unless you provide all required account documentation within 30 days of account opening.

- Maximum $500 bonus per business (per Tax ID Number) and may not be combined with other offers.

- You are responsible for any federal, state, or local taxes due on the bonus and we will report as income to the tax authorities if required by applicable law.

- Consult your tax advisor.

- Offer is subject to change and may be withdrawn at any time. Member FDIC

- Promo Code: BIZSUMMER25

Newtown Savings Bank Up to $400 Checking Bonus (Expired)

- What you’ll get: Up to $400 bonus

- Account Type: Checking

- Availability: CT (Bank Locator)

- Direct Deposit Requirement: Yes (see what works)

- Credit Inquiry: Soft Pull

- ChexSystems: Yes, sensitive

- Credit Card Funding: Fund up to $25

- Monthly Fees: None with Free Checking

- Early Account Termination Fee: 90 days, bonus forfeit

- Household Limit: One

(Expires 06/30/2025)

Editor’s Note: Many combination here between checking and savings account to earn up to $400 bonus. It’s possible to get up to $200 bonus without direct deposit with the Student Checking and Basic Money Account.

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- $250 Bonus:

- $250 for opening a Flagship Checking Account with direct deposit

- $100 Bonus:

- $100 for opening a Free Checking Account with direct deposit

- $50 Bonus:

- $50 for opening a Student Checking Account and completing 5 debit card point-of-sale purchases

- $50 or $150 Bonus:

- $50 with Statement Savings or $150 with Basic Money Market with any checking account shown above.

- To earn a $50 bonus in your Statement Savings Account, you must open your account, deposit $300 or more, and maintain the balance daily for a period of 60 days, OR in conjunction with the checking offers described above,

- To earn a $150 bonus in your Basic Money Market Account, you must open your account, deposit $20,000 or more, and maintain the balance daily for a period of 60 days.

- $50 with Statement Savings or $150 with Basic Money Market with any checking account shown above.

- Promo code SPRING25

- Offers are available for the above personal accounts opened from April 28, 2025, through June 30, 2025.

- To be eligible for these offer(s), all account holders must be new checking account customers (must not have had an open personal Newtown Savings Bank checking account within a 12-month time period).

- A qualifying direct deposit of $500 or more for Flagship Checking, or $100 or more for Free Checking, must be received into the respective checking account within 60 days after account opening and bonus amount will be deposited into the respective checking account by 8/31/2025.

- If your account balance is negative on or prior to 8/31/2025, the bonus will not be paid.

- A qualifying direct deposit is salary, pension, Social Security, or other regular monthly income, electronically deposited through the Automated Clearing House (ACH) network by your employer or an outside agency.

- Non-qualifying direct deposits for purposes of this offer include transfers from one account to another (for example, transfers between your own accounts, or person-to-person transfers using a transfer service such as Venmo or Zelle®), or deposits made at a branch or ATM, or through mobile deposit.

- To earn a $50 bonus in your Student Checking Account, you must make 5 point-of-sale purchases with your debit card within 60 days after account opening (ATM transactions do not count as purchases) and bonus amount(s) will be deposited into the respective checking account by 8/31/2025.

- In conjunction with the checking offers described above, to earn a $50 bonus in your Statement Savings Account, you must open your account, deposit $300 or more, and maintain the balance daily for a period of 60 days, OR in conjunction with the checking offers described above, to earn a $150 bonus in your Basic Money Market Account, you must open your account, deposit $20,000 or more, and maintain the balance daily for a period of 60 days.

- Your savings or money market bonus will be credited to your account by 8/31/2025 if you meet both the checking requirements and the savings or money market balance requirements.

- Maximum $400 bonus per household and may not be combined with other offers.

- Personal checking, savings and money market accounts have a minimum deposit of $25 to open.

- The required minimum balances to waive monthly maintenance fees are as follows: $250 for Statement Savings; $1,000 for Basic Money Market account.

- Flagship Checking requires a $2,500 minimum daily account balance, or primary account owner maintains a $20,000 combined daily balance in all deposit accounts, including Certificates of Deposit, owned by the Primary Account Holder at Newtown Savings Bank to waive the monthly maintenance fee.

- The Annual Percentage Yields (APYs) for Flagship Checking, Statement Savings and Basic Money Market account subject to change after the account is opened.

- The minimum to earn the APY is $0.01 for Flagship Checking, $10 for Statement Savings, and $20 for Basic Money Market. Fees may reduce earnings.

- If your checking, money market or statement savings account(s) are closed within 90 days after opening, the bonus amount(s) will be deducted at closing.

- You are responsible for any federal, state, or local taxes due on the bonus and we will report as income to the tax authorities if required by applicable law.

- Consult your tax advisor.

- Newtown Savings Bank employees are not eligible for these offers.

- Offer is subject to change and may be withdrawn at any time.

- We do not charge for mobile banking.

- Your mobile device provider may charge you fees.

- Please check with your carrier.

- Member FDIC

- Promo Code: SPRING25

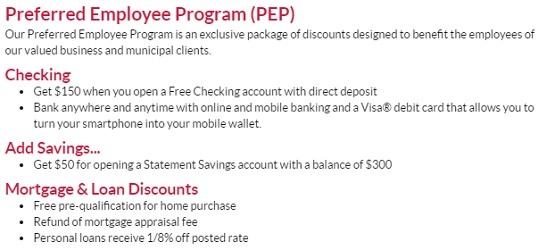

Newtown Savings Bank $200 Checking & Savings Bonus (PEP Program) (Expired)

Earn a $200 Checking & Savings Bonus

Newtown Savings Bank is offering a $200 Checking & Savings Bonus when you open a new qualifying account.

- What you’ll get: $200 bonus

- Account Type: Any Account

- Availability: CT

- Direct Deposit Requirement: Yes (see what works)

- Credit Inquiry: Soft Pull

- ChexSystems: Yes, sensitive

- Credit Card Funding: Fund up to $25

- Monthly Fees: None with Free Checking

- Early Termination Fee: 90 days, bonus forfeit

- Household Limit: One

(Expires 12/31/2022)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | HSBC Premier Checking (Up to $3,000 Cash Bonus), |

How To Earn Bonus

- Open a qualifying checking account.

- The offer amount will be deposited into the respective checking account within 60 days after if the qualifying direct deposit payment has been made

- Open a Statement Savings account along with the checking offer described above and deposit and maintain $300 for 60 days after being opened to earn a $50 bonus in your Statement Savings Account

- Offers available for the above personal checking and statement savings accounts opened in 2021.

- Free Checking: The offer amount will be deposited into the respective checking account within 60 days after if the qualifying direct deposit payment has been made.

- A qualifying direct deposit is salary, pension, Social Security, or other regular monthly income, electronically deposited through the Automated Clearing House (ACH) network by your employer or an outside agency.

- Non-qualifying direct deposits for purposes of this offer include transfers from one account to another (for example, transfers between your own accounts, or person-to-person transfers using a transfer service such as Venmo or Zelle®), or deposits made at a branch or ATM, or through mobile deposit.

- Savings: Open a Statement Savings account along with the checking offer described above and deposit and maintain $300 for 60 days after being opened to earn a $50 bonus in your Statement Savings Account.

- Maximum $200 per household and may not be combined with other offers.

How To Waive Monthly Fees

- Free Checking: None

- Performance Money Market: None

- Everywhere Checking: $8 monthly fee.

- Interest Checking: $12 monthly fee. Maintain a $750 minimum daily account balance or primary account owner maintains $5,000 combined daily balance, or automatic payment to a Newtown Savings mortgage. to avoid the monthly account fee

- Flagship Checking: $25 monthly fee. Maintain a $2,500 minimum daily account balance or primary account owner maintains a $20,000 combined daily balance to avoid the monthly account fee

- Student Checking: $10 monthly fee. Age 23 or Younger to waive

- New Start: $5 monthly fee

- Flagship Business: $35 monthly fee. Maintain a $35,000 average monthly balance to avoid the monthly account fee

- Cornerstone Plus Business: $15 monthly fee. Maintain a $5,000 average monthly balance to avoid the monthly account fee

- Cornerstone Business: $10 monthly fee. Maintain a $1,000 minimum daily balance to avoid the monthly account fee

- Business NOW: $12.50 monthly fee. Maintain a $1,500 minimum daily balance or $35,000 combined deposit balance to avoid the monthly account fee

|

|

Bottom Line

I recommend opening the Free Checking account from Newtown Savings Bank. This account has no monthly service fees while still receiving the same benefits as the Everywhere Checking account.

While they have a generous $100 bonus, Newtown Savings Bank doesn’t have great rates for CDs and Savings. You may want to check out our full list of Bank Rates and CD Rates.

*Compare Newtown Savings Bank Promotions with other bank bonuses from banks like Citi, Huntington, HSBC, Chase, TD, Discover Bank, Aspiration, Axos Bank, PNC Bank, BMO, SoFi, Fifth Third Bank, Bank of America, Wells Fargo, US Bank, and more!*

*Check back at this page for updated Newtown Savings Bank promotions, bonuses and offers.