If you were looking to keep control over your spending or simply want to organize your personal finances, you might want to look into downloading a personal finance app.

Rather than doing all the research on your own, we have compiled an in-depth guide to help you out. With this guide, you will get insight on everything that you need to know about best personal finance apps out there currently.

Things To Look For In A Personal Finance App

A personal finance app will make your money management and budgeting process must easier. Each app has different functionalities but there are some key similarities to keep in mind.

It’s Intuitively Designed

Some apps might be confusing to use so it won’t be as beneficial to you. Some apps may be more compatible with certain devices. If you service costs money, you should take advantage of the free trial version if available. Before you commit to a paid service, you are able to test out their functionalities to see if you like it.

It Automatically Syncs To Accounts

Personal finance apps allow you to sync up all your financial accounts (i.e. bank accounts, credit cards, investment accounts, etc.) into one. From a single location, you can automatically track, analyze and categorize every transaction made. Rather than logging into each individual account to manually update your spending’s, this will save you plenty of time.

It Gives A Complete Picture

A good app will track your income and expenses, keep notes on your savings accounts, debts and more, to provide you with a clearer view of your personal finances.

It Accounts For Fluctuating Income & Expenses

You never know how your money is coming in or going out. We recommend you look for a budgeting app that doesn’t lock you into the same monthly amount for your income. For expenses, you’ll want to be able to devote the average monthly expense amount. To do this, divide the total of all expected monthly payments in a year by 12.

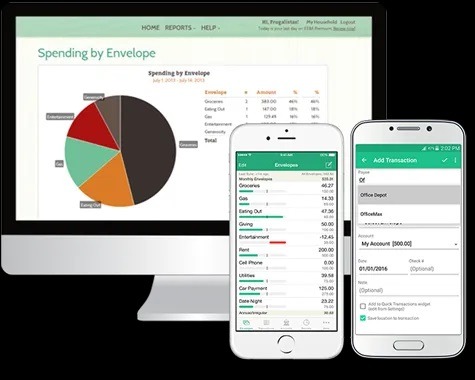

To account for fluctuating income & expenses, another great is to use software based on the envelope budgeting system.

It Generates Budget Reports

Financial apps should have reports that show your progress on a monthly, quarterly and annual basis. To watch your spending’s even further, look for a software that gives weekly reports or something that gives you real-time information.

It Can Export Your Data

Most budgeting apps will allow you to export your data to a CSV file to be imported onto a spreadsheet. This is a great feature if you go with an app that allows you to track transactions from multiple financial accounts. Rather than manually entering in data, exporting data will save you hours of work.

The Best Personal Finance Apps For The Year

Below, we have listed a few of our favorite personal finance apps. These apps have many of the features listed above, as well as unique features to make them stand out from the rest.

Keep in mind that the prices for each app were retrieved at the time of this write-up. Please check for current pricing.

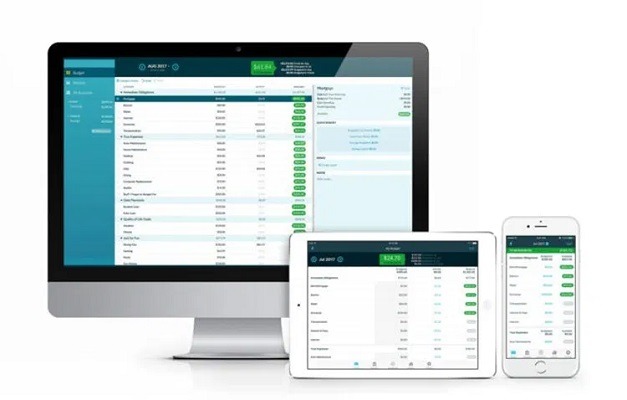

Best Overall: YNAB

YNAB is a solid option for both budgeting beginners or professional. It is effective and easy to use, making it one of the best overall personal finance apps on the market. You can get a clear overview of your budgeting progress and finances, as well as free online classes to learn how to make budgeting into a habit.

Cost: 34-day free trial, $11.99/month, $84/year

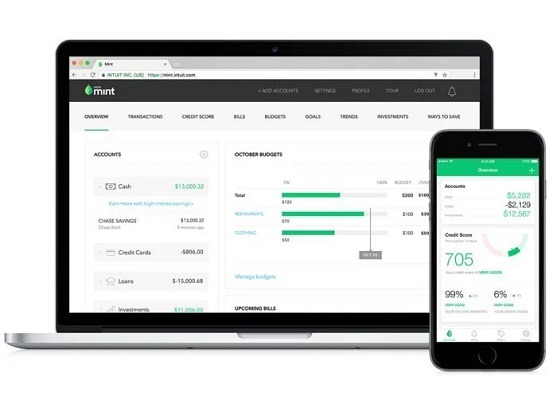

Most Popular: Mint

There are currently over 20 million users at Mint. This budgeting app automatically syncs to your bank, credit card and investment accounts, easily pulling data all for free.

Cost: Free

Best Digital Envelope System: Mvelopes

Mvelopes is a great way to get a complete picture of your financial situation all from the app. Mvelopes also offers personal coaching sessions to see where your money is going, find budget holes, and motivate you to be debt free.

Cost: $5.97+/month, $69+/year, Premier comes with 30-day free trial

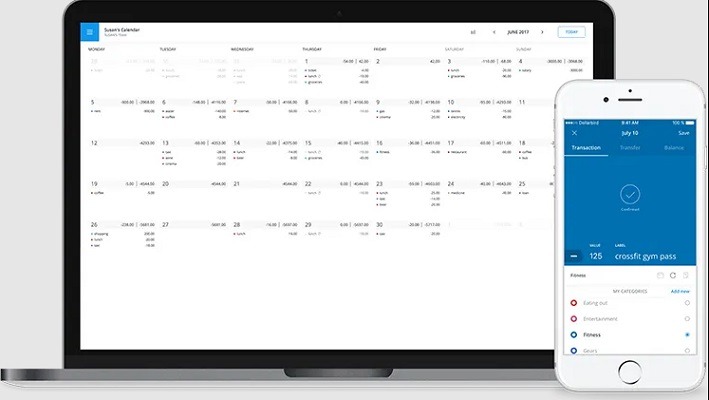

Best Calendar-Based System: Dollarbird

Dollarbird has a unique calendar system to keep track of your daily spending. The cloud-based platform is available for your browser, iOS and Android. It features cash flow forecasting as well as the ability to share calendars with other team members.

Cost: Free, $4.99/month, $39.99/year

Best with Basic Tools: Pennies

Pennies is a simple budgeting app that many users can learn to operate. Pennies is Apple’s “Editor’s Choice” winner, stacked with the basic tools you need to track your money.

Cost: $3.99 one-time fee (iOS only)

Best for Overspenders: PocketGuard

PocketGuard analyzes your finances to see if it fits your spending demands. This app is great for those who are short on cash every month, or if you don’t know how to save money. The free version will let you see how PocketGuard works before you commit to the paid subscription service.

Cost: Free, $3.99/month, $34.99/year

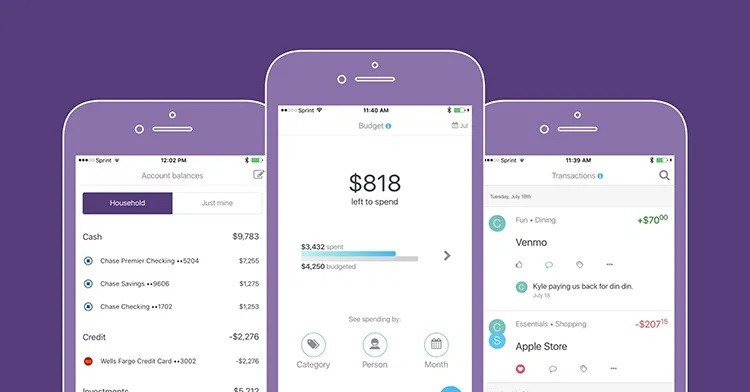

Best for Couples: Honeyfi

Finances is definitely a leading problems in a serious relationship. Luckily, Honeyfi is a personal finance app designed for couples. This service offers money management and budgeting tools plus you and your partner can communicate and stay updated with finances.

Cost: 30-day free trial, $60/year/couple

Best for Families: Goodbudget

Goodbudget will break down your budget by categories and put your spending in perspective with personalized reports in a simple and effective manner. The ability to access one account from many devices is particularly useful for families who want to share their spending activity.

Cost: Free, $7/month, $60/year

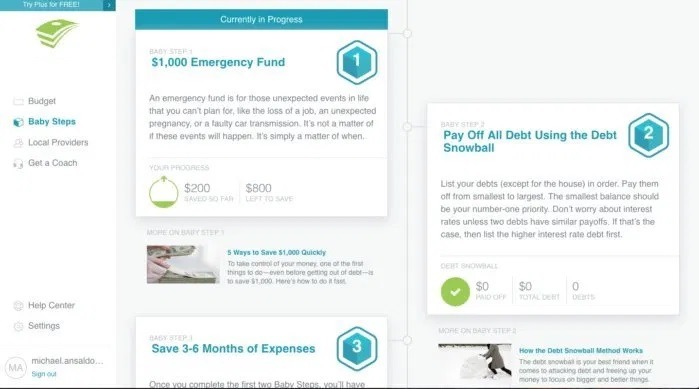

Best for Baby Steps Fans: EveryDollar

For anyone who is currently trying to get out of debt, EveryDollar is a great app for you. The services uses Dave Ramsey’s Baby Steps method to help you break free from debt. It’s simple and easy to add transactions, customize categories and create funds, and it syncs automatically to your significant other’s phone. Take advantage of their free 15-day trial to test EveryDollar Plus.

Cost: Free, $99/year

Best for College Students: Pluto

Pluto was created by other students and is designed for college students who are looking to focus on their budgeting. Pluto turns your goals and personal finance into fun weekly challenges to motivate you to your reach those financial resolutions.

Cost: Free, iOS only

Best for Investors: Personal Capital

Personal Capital offers free analysis of investments, automated tracking of transactions from linked accounts, cash flow and budgeting tools. A complete investment advising solution combines robo-advisor and human advisor service.

Cost: Free (for financial planning and 401(k) allocations)

Best for Happy Spending: Joy

Joy is a great option to work on spending habits. This app helps you take inventory of your finances by keeping an eye on how you spend so you can manage your money better.

Cost: Free

Best with Quicken & Mint Migration: CountAbout

A great competitor to Mint would have to be CountAbout. This personal finance app allows you to keep track of your spending, categorize transactions, and create and manage your budget. The best part is, you can migrate your Quicken and Mint data as well as syncs your old and new financial information.

Cost: 15-day free trial, $9.99+/year

|

|

|

|

Bottom Line

We have compiled a list of what we considered as some of Best Personal Finance Apps Of 2021. Keep in mind that some apps were created for different wants and needs so be sure to take advantage of the free trials before committing.

If you know of any other good apps that we did not mention, feel free to drop us a comment below! If this is something that interests you, check out our list of Best Brokers Promotions as well as Best Bank Bonuses.