Growing your savings can be a difficult task, but as long as you know how to calculate interest, it’ll be a breeze. Being able to calculate your interest will help you plan for the future and understand your progress toward your goals.

This task is simple to do if you use free spreadsheets or online calculators. In this post, we will go over simple interest, single investments, compound interest, and ongoing investments.

I recommend the Savings Builder Account from CIT Bank or the Discover Online Savings Account!

How to Calculate Interest You Earn

Basically, interest is the cost of money. Whenever you lend money or deposit funds into an interest-bearing account, you will get a certain amount of money back plus more. The extra amount you get back is interest, or the compensation you earn for someone else hold your money.

Get organized: To calculate the interest earned from a savings account, you must gather the following components:

- The amount of your deposit or the amount you lend, using the variable “P” for principal.

- How frequently to calculate and pay interest (yearly, monthly, or daily, for example), using “n” for the number of times per year.

- The interest rate, using “i” and the rate in decimal format.

- How long you earn interest for, using “t” for the term (or time) in years.

Example: Let’s say you deposit $100 into your bank account, you earn interest annually, and the account pays 5%. How much will you have after one year?

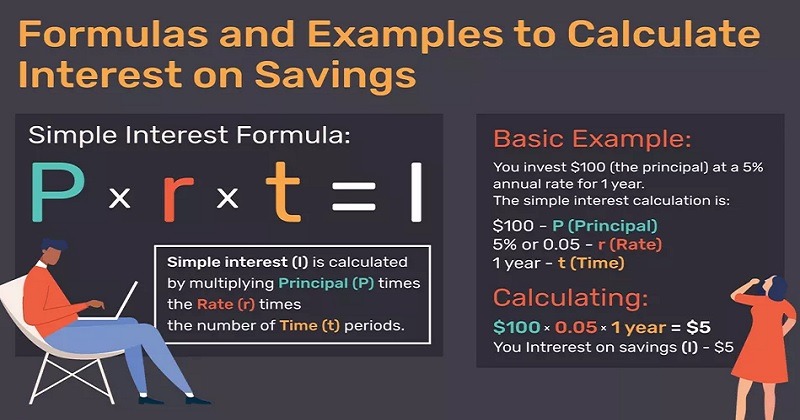

For this calculation, we will use the simple interest formula, which is principle multiplied by the interest rate multiplied by the amount of time that passes.

Therefore, in this problem we can say

- Principle x Rate x Time

- $100 x 5 percent interest earned x 1 year = $5 earned

The calculation above works only if your interest rate is quoted as an annual percentage yield (APY). Instead of interest rate, most banks will advertise this number as “APY” which makes it look better because it’s a higher number.

However, if you only know your rate, or if you want more detailed numbers, you will need to use a different formula or spreadsheet. If banks calculate interest monthly and add earnings to your account each month, then the formula above will not be accurate.

Calculate Compound Interest

The process of compounding happens when you earn interest. Afterwards, the money you earned generates even more interest.

To calculate compound interest on savings account, your formula needs to have these two things:

- More frequent periodic interest payments into the account, instead of one annual payment. For example, your bank might pay interest monthly.

- An increasing account balance that subsequent interest calculations depend on.

Now, continuing with the example above, we will now use the compound interest formula to calculate your total earnings after one year.

- A = P (1 + r/n) ^ nt

- A = $100 x (1 + 0.05/12) ^ (12 x 1) = $105.117

If you’re confused as to what the sign “^” means, it is simply an exponentiation, which means the number is raised to the power of another. For example, “x^2” means “x squared” or x raised to the second power.

In our example, you can see that compound interest leads us to have a slightly higher calculation. Although 5% is the interest rate in the example, the APY is actually 5.12%. In conclusion, banks that pay interest more frequently than annually, the APY is higher than the stated annual interest “rate.”

Calculate with a Spreadsheet

If all the math is tiring you out, then spreadsheets is the way to go. It can help keeping track of all the numbers much simpler and can automate the process for you.

To make the spreadsheet from scratch, start by entering the following in any cell to figure your earnings using simple interest: “=FV(0.05,1,0,100)”

- Interest rate

- Number of periods

- Periodic payment (if any)

- Future value (unless you’re starting with zero)

- Optional value for the beginning or end of period (not shown here)

The expression above uses the simple interest example from earlier in the post. This does not show compound interest because there is only one compounding period.

For a more advanced spreadsheet, you must enter the rate, time and principal in separate cells. This way, you can always change the cells from your formula easily.

For compound interest, you will need to adjust several numbers. For example, you will need to change annual rate to a monthly rate by dividing the 5% from above by 12 months. Next, you will convert the number of period to 12.

Ongoing Savings

So far, the examples we’ve given you assumes you only make a single deposit. If you were to make monthly investments, you would need to modify your calculations or your spreadsheet formula.

For example, if you deposit $100 per month for the next five years, starting from zero, you could use this spreadsheet formula: “=FV(0.004167,60,100)“. Note, you use a monthly interest rate, that is why the number of periods is 60 months.

To calculate this number by hand or by calculator, you will use the formula “FV = Pmt x (((1 + r) ^ n) – 1)/r)“. This calculation will be slightly more difficult due to the amount of things you have to keep track of.

|

|

Bottom Line

Calculating interest doesn’t have to be that hard as long as you use some of the tips we have provided above. Doing so will help you plan for your financial future and know what accounts are a good deal and which ones aren’t.

If you like posts like this, check out our list of Bank Guides and Bank Bonuses!