Valley National Bank is prideful of their competitive CD rates with high interest, and is considered one of the best banks when it comes to CD accounts. To find out if Valley National Bank is right for you, continue reading the review below.

Valley National Bank is prideful of their competitive CD rates with high interest, and is considered one of the best banks when it comes to CD accounts. To find out if Valley National Bank is right for you, continue reading the review below.

Recently, Valley National Bank has re-branded itself to simply “Valley” in October of 2018. They serve business and personal banking customers in New York, New Jersey, Pennsylvania, Florida and Alabama. They have more than 230 locations across these states.

Checking Account Options

Valley National Bank has a wide variety of checking accounts that can serve people at any stage of life.

Each one comes with unique pros and cons, so make sure you think carefully about which one would work best for you.

Check out the latest bank offers here.

With an opening deposit of $100, this account is a little bit harder to open, but has no balance requirement.

Additionally, if you deposit $750 monthly, you can also earn an extra $20 a month.

This is a great account for those starting out in the banking world.

It has a low opening requirement of $25, and has no monthly service fee.

You will also be able to get free ATM transactions, so this account has very low costs associated with it.

For teenagers (ages 13-16) who want to start saving up money, this is a great account for their parents to look into.

It has a low opening deposit of $25, and there is no monthly service fee if the account is linked with a guardian, or if there is a balance of $1,000 or higher.

This is a great account to open if you are looking to earn a little bit of interest on your checking cash.

This account requires a $100 opening deposit, and you must maintain a daily balance of $1,000 per month

This is an account for senior citizens 55 or older and require no minimum balance requirement in order to open it.

Compare Checking Accounts

|

Savings Account Options

Valley National Bank has a lower variety of savings account when compared to their checking, but they all offer a steady interest rate, and have accounts that are tailored for all age groups.

You can view more interest bearing accounts here.

This is the standard savings account that is available to everyone.

It requires a $100 opening deposit and comes with an ATM card that allows you to access your account if needed.

If you maintain a balance of $300 you can waive the monthly service fee.

The Valley Kids First Savings Club enables children to begin saving up with as little as $1, and there are no monthly fees.

They encourage saving by matching your first child’s deposit up to $20.

This savings account can be opened with a $10, $20, $25, or a $50 opening deposit.

If you open with at least $20, then you can get a special gift.

This savings account can be opened for medical expenses and has a low monthly fee of $3. This is recommended if you are registered for a high deductible health plan.

Compare Savings Accounts

Money Market Account Options

Money Market accounts allow for a higher yield and gives access to your funds with either checks or a bankcard. Valley National Bank offers money market accounts that earn competitive interest rates.

You can view more of the best money market promotions here.

If you manage to maintain an overall balance of $10,000 per month, then you can waive the monthly fee. If you fail to do so, you will be charged $25.

This account earns interest, but you will need a $2,000 minimum deposit to open it.

Just like the Tiered Money Market, you will need to maintain an overall balance of $10,000 each month to waive the monthly fee, and failure to do so will result in a $25 fine.

Another account that earns decent interest except you need a minimum of $25,000 to open it instead.

Compare Money Market Accounts

CD Account Options

Valley National Bank has decent rates on their CD’s, and a huge variety of different dates that you can invest your money in.

Since they are known for their competitive CD rates, down below is a convenient chart that lists all the terms and APY. Be sure to go through all the different ones before choosing to invest in a CD.

Compare CD Accounts

• Available nationwide online, Discover® offers CDs with some of the highest & most competitive rates! with select terms as short as 3 months up to 120 months • Rates ranging from 2.00% APY up to 4.05% APY. • Opening a Discover Bank Certificate of Deposit is extremely quick and easy. • Funds on deposit are FDIC-insured up to the maximum allowed by law. • Get started and open a Discover CD in 3 easy steps. |

IRA Account Options

Valley offers both traditional and Roth IRAs. With traditional IRAs, contributions may be tax-deductible and withdrawals are taxed at your ordinary income tax rate in retirement.

Roth IRAs don’t offer a tax deduction but qualified withdrawals are tax-free.

Reasons To Bank with Valley National Bank

- They offer high and competitive interest rates with all their account options.

- They have a wide variety of CDs ranging from 7 days up to 72 months, and all of them earn high APY.

- Valley National Bank has a mobile app and website where you can handle your banking online instead.

- People who live in New York and New Jersey benefit greatly because there are over 200 branches in those locations.

- If you live in the East Coast area, then you will most likely be able to find a Valley National Bank ATM and you can use your VNB debit card free of charge.

- Kids (16 and under) and senior citizens can open a checking or savings account without having to worry about monthly fees.

Reasons Not To Bank with Valley National Bank

- They are only located in 4 states: New York City, New Jersey, Florida and Alabama, but New York has the most branches.

- They don’t have the best savings account options since the bank promotes having better and higher interest rates instead.

Valley Nation Bank Routing Number

Their routing number is 021201383. You can also find your routing number on the lower left corner of your Valley National Bank check.

Contact Customer Service

Reach Valley National Bank Customer Service at 1 (800) 522-4100. Their hours vary from branch to branch, but there are a few locations that are open 24 hours

To find a branch closes to you, make sure you use their Locator so you can find out when you can get in touch with them.

How Valley National Bank Compares

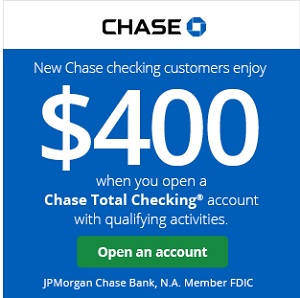

- Chase Bank: Chase is one of the biggest banks in the U.S and offers just about almost everything. Compared to its other competitors, Chase offers much more checking account options.

- Bank of America: As one of the larger banks in the U.S. Many may choose BoA for the convenience of locations through out 35 states. However, BoA offers limited account options.

- PNC: Also having a New York location, PNC Bank offers free access to f PNC Bank ATMs, free mobile/online banking, reimbursement of PNC fees for use of non-PNC ATMs, and many other features that can be found on their website. They have several account options.

- Capital One 360: Capital One 360, you can bank fee-free with online and mobile checking that actually pays you back. Whether you’re looking for one of their 40,000 fee-free ATMs or a Capital One location–chances are they are right nearby.

- Wells Fargo: Located throughout the US with over 5,800 branches and 13,000 ATMs. They offer a variety of deposits accounts, including accounts for teens and customers who need a second chance.

|

|

|

|

Bottom Line

If you are more interested in investing your time and money into accounts, especially CD accounts, then perhaps Valley National Bank can be of service to you.

They have some of the best CD accounts to offer, constantly earning competitive interest rates. Their IRA rates are something to consider as well. If you are interested in checking out other banks in the New York area, click here.

However, keep in mind that when you look for a checking or savings account be sure to look into all the fees charged. Don’t focus on the interest rate alone, but on what the account will cost you overall.

It’s very important to keep in mind the potential fees that may incur and how to avoid them if possible. If Valley National Bank has the variety and options you’re looking for, apply today!

For more options from a variety of banks, see our list of the best bank promotions and keep up with the latest Valley National Bank Promotions.

Helpful Tips:

The best bank bonuses are updated here. Check the below pages to get started with some of the best offers: • Chase Bank Bonuses. Read about several offers for their Checking, Savings and Business accounts. Chase usually offers the most sign-up bonuses of all the big banks. • HSBC Bank Bonuses. HSBC Bank routinely has offers for several of their Personal Checking and Business Checking accounts. They also have a good referral program. • TD Bank Bonuses. TD Bank consistently offers great Checking account bonuses all year long. Savings account offers are less frequently available. • Huntington Bank Bonuses. Bonus offers for their Checking accounts are only available for limited periods throughout the year. They also have great options for those looking for a free Checking account (no monthly fees). • Discover Bank Bonuses. Discover Bank offers top cashback, savings, money market accounts and CD rates for you to take advantage of. Discover has industry leading selections to cater to your banking needs. |

Leave a Reply