Located throughout the South and Midwest, Simmons Bank offers an abundance of account options. To find out if Simmons Bank is right for you, continue reading the review below.

They have a decent range of checking and savings account for various occasions for reasonable minimum requirements.

Checking Account Options

Simmons Bank has a decent variety of checking accounts that comes with different benefits. Be sure to read through all the details before applying to any account.

This is Simmons Bank’s basic checking account. You will need a minimum deposit of $100 to open it.

There is a $6 monthly fee, but you can waive it by having a daily balance of $500 or a monthly balance of $1,000.

This account also comes with a Simmons Bank Debit Card, free online banking and overdraft service options.

To earn interest on this checking account, you will need a minimum deposit of $100. The interest earn will be tiered.

There is a monthly fee of $10, but by having a $1,000 daily balance, you can waive it.

This account also comes with a Simmons Bank Debit Card, free online banking and overdraft service options.

You will also need a $100 to open this account.

There is a monthly fee of $10, but you can waive it by maintaining a daily balance of $1,000.

This account also comes with a Simmons Bank Debit Card, free online banking and overdraft service options.

You will need a minimum deposit of $50 to open this account, but there are no monthly fees to worry about afterwards.

You will also receive a Simmons Bank Debit Card, free online banking and overdraft service options.

This checking account is for those who tend to keep a lower balance instead.

You will need a minimum balance of $25 to open this account.

There is also an unavoidable monthly fee of $5 to consider as well.

You will also receive a Simmons Bank Debit Card, free online banking and overdraft service options.

Compare Checking Accounts

|

Savings Account Options

Simmons Bank has a small selection of savings accounts, but they earn decent interest rates.

This is a basic savings account that requires $100 as an minimum opening deposit.

There is a small monthly fee of $5, but you can waive it if you have at least $100 in your account daily.

You are allowed up to 6 withdrawals per month, and the interest is earned daily based on your balance.

This savings account is for minors who are 18 or younger. You only need a minimum deposit of $10 to open it.

You are also allowed up to 6 withdrawals per month, and the interest is earned daily based on your balance.

This savings account is designed for those who wants to set aside their earnings to pay for health expenses.

This account earns interest daily, but you will need $100 to open it.

Compare Savings Accounts

Money Market Account Options

Money Market accounts allow for a higher yield and gives access to your funds with either checks or a bankcard. Simmons Bank offers one money market that earns tiered interest rates.

Simmons Bank Money Market:

- Requires a $100 minimum opening deposit

- Interest is compounded monthly based on your balance

- There is $15 service charge if the balance falls below $1,000

- For current rates contact your local branch

Compare Money Market Accounts

Reasons to Bank with Simmons Bank

- They have a decent selection of checking and savings accounts.

- Their opening deposit requirements are low.

- Their monthly fees are easily waiveable.

- They have youth savings account to encourage children to save responsibly.

- They have a health savings account to you can set aside your money for expenses.

- Conduct all your banking online or on the Simmons Bank mobile app.

Reasons Not to Bank with Simmons Bank

- Simmons Bank only operates in 7 states: Arkansas, Colorado, Kansas, Missouri, Oklahoma, Texas and Tennessee.

- They have a low variety of savings accounts.

- They only have one money market.

- Their CDs are kind of vague, they don’t have any variety.

- They lack a free checking account.

- The interest rates aren’t that high, you could probably find better ones elsewhere.

Simmons Bank Routing Number

Simmons Bank’s routing number is 082900432.

Contact Customer Service

Simmons Bank has a a regular phone number and a 24 hour telephone banking number.

To speak to a customer representative, call: 1-866-246-2400

For 24 Hour Telephone Banking, call: 1-877-245-1234

How Simmons Bank Compares

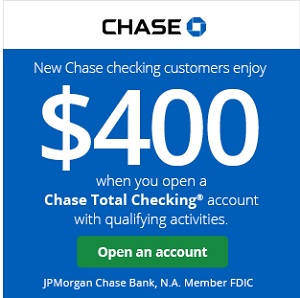

- Chase Bank: Chase is one of the biggest banks in the U.S and offers just about almost everything. Compared to its other competitors, Chase offers much more checking account options.

- Huntington Bank: Huntington offers a variety of account options to choose from. Right now, Huntington is offering bonuses when you sign up for select checking accounts, including business ones!

- Wells Fargo: Located throughout the US with over 5,800 branches and 13,000 ATMs. They offer a variety of deposits accounts, including accounts for teens and customers who need a second chance.

- Bank of America: As one of the larger banks in the U.S. Many may choose BoA for the convenience of locations through out 35 states. However, BoA offers limited account options.

|

|

|

|

Bottom Line

Overall, Simmons Bank offers simplistic and basic accounts, but are open to anyone.

However, keep in mind that when you look for a checking or savings account be sure to look into all the fees charged. Don’t focus on the interest rate alone, but on what the account will cost you overall.

If Simmons Bank has the variety and options you’re looking for, apply today! For more options from a variety of banks, see our list of the best bank promotions!

Leave a Reply