If you’re a Chase customer, you’re probably located near several different Chase bank branches or ATMs. Personally, I have about 3 different Chase bank branches that are nearby.

If you’re a Chase customer, you’re probably located near several different Chase bank branches or ATMs. Personally, I have about 3 different Chase bank branches that are nearby.

For those of you who need to find the nearest Chase location, I’ve put together this guide on How to Find a Chase Branch or ATM.

Editor’s Note: We recommend taking a look at the popular Chase checking account in which you can earn a generous bonus when signing up. If you’re a business owner, definitely consider the Chase Business Checking account and set yourself ahead in a terrific business account.

About Chase Bank

Established in 1982 as The Chase Manhattan Bank, they are currently headquartered in Newark, Delaware. They have several Chase ATMs and branches throughout the U.S.

- Availability: Branch Locator

- Routing Number: See full list

- Customer Service: 1 (800) 935-9935

While being one of the largest banks in the United States, Chase isn’t located in every state. However, their online and mobile banking app allows customers to access their account and funds from anywhere.

Keep reading to find the closest branch or ATM near you using the online site and the mobile app.

How to Find Chase Branch or ATM

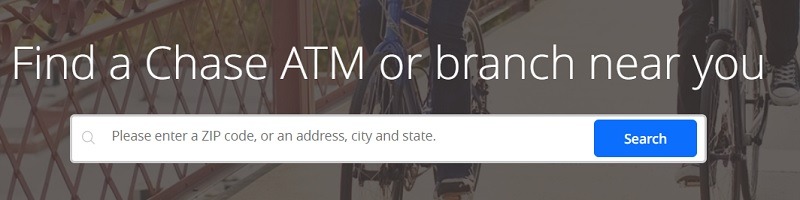

Chase makes it incredibly simple to find the nearest branch. Simply enter your current location in the search tab and you will be given your closest branch or ATM. Additionally, you can narrow your searches down using filters.

- Head to the Chase Locator page.

- Type in your zip code or address in the search box in the middle of the page.

- If you used the search bar, you will arrive at a page that shows you the nearest Chase locations on a map.

- You can also narrow down the results with multiple filters.

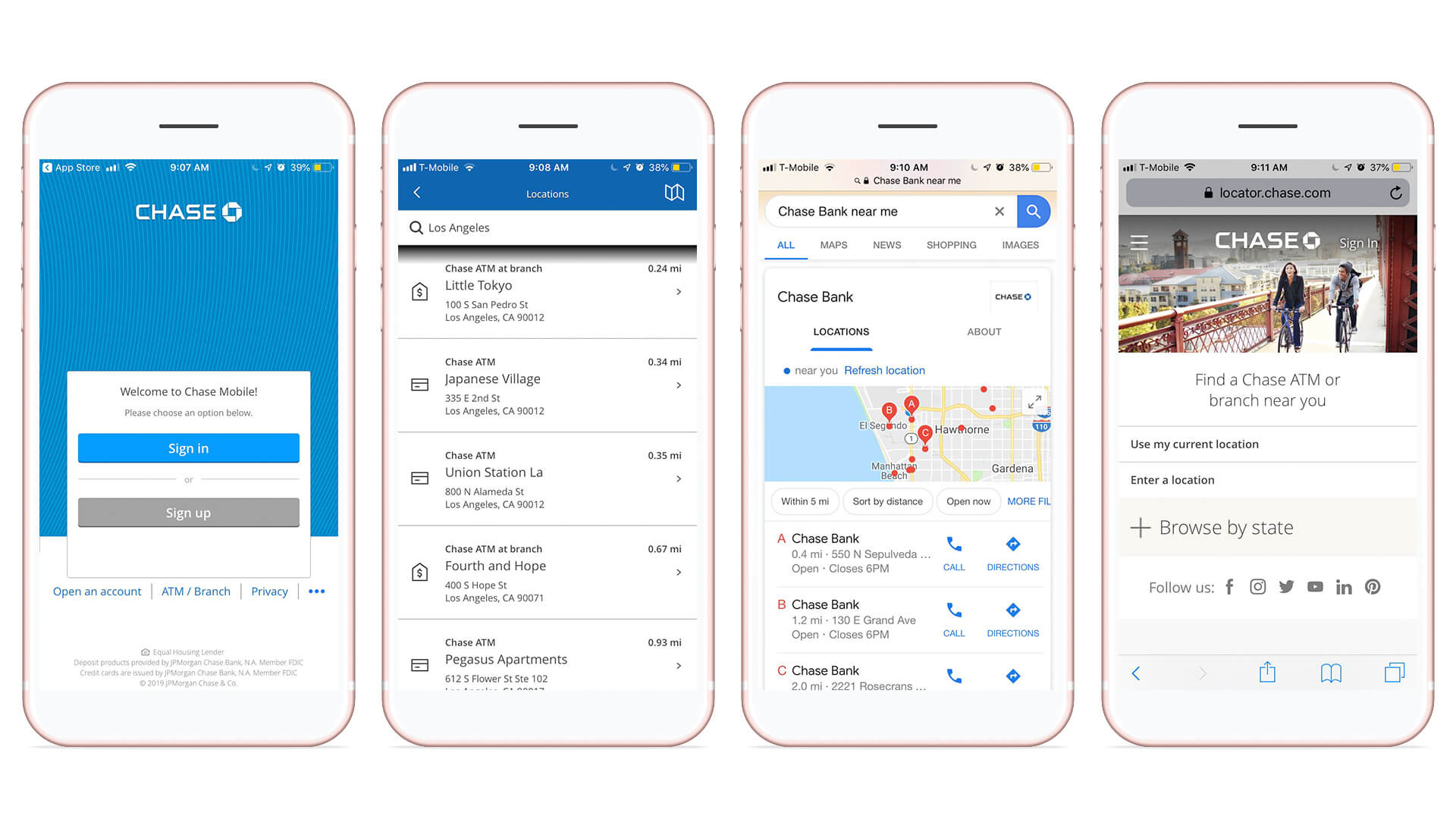

Using the Chase Mobile® App

The Chase Mobile® App has features such as requesting a Stop Payment, Chase QuickPay for Money Transfers, Chase QuickDeposit, and finding the nearest branch and ATM.

- Open the Chase Mobile® App and sign in to your account.

- On the top left corner press the three horizontal lines for additional features.

- Next, scroll to the very bottom and select Find Us – “ATM & Branch”.

- If your location services are turned on for the Chase Mobile® App you will automatically be given your nearest branch and ATM. However, you can also manually enter a location to find the nearest branch or ATM.

It is required to have an account at Chase to use the Chase Mobile® App. We recommend you apply for one of the Chase Bank Promotions such as the Chase Premier Plus CheckingSM account or the Chase Total Checking®account that can earn you a bonus and exceptional banking experience.

Using Chase Customer Service

Alternatively, you can also call customer service if you do not have internet access for the Chase Mobile® App or online site.

- To contact Customer Service, dial 1-800-935-9935.

- Follow the menu to get to the Find Nearest Branch or ATM prompt.

- The telephone branch and ATM locator system are speech directed meaning the system asks you questions and you provide voice responses. You’ll be asked about the type of banking service you need and your location. The system then uses these answers to give you information about branch locations.

Chase Credit Cards

Personal Chase Credit Cards

The Chase Sapphire Preferred® Card offers 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. You'll earn: • 5x on travel purchased through Chase TravelSM • 3x on dining, select streaming services and online groceries • 2x on all other travel purchases • 1x on all other purchases • $50 Annual Chase Travel Hotel Credit • Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027. Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase TravelSM This card carries a $95 annual fee. |

The Chase Sapphire Reserve offers 100,000 points + $500 Chase Travel promo credit after you spend $5,000 in purchases in the first 3 months from account opening. You'll earn • 8x points on all purchases through Chase Travel, including The Edit • 4x points on flights?booked direct • 4x points on hotels?booked direct • 3x points on dining worldwide • 1x points on all other purchases This card does carry a $795 annual fee and there are no foreign transaction fees. However, you're able to earn a $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year & up to $120 application fee credit for Global Entry or TSA Pre?®, and more annual value from perks and benefits. Member FDIC |

The Chase Freedom FlexSM offers a $200 bonus after spending $500 on purchases in your first 3 months from account opening. 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR. You'll earn: • Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter! • 5% cash back on travel purchased through Chase Travel?, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • Unlimited 1% cash back on all other purchases You cash back rewards do not expire as long as your account is open and there is no minimum to redeem for cash back. This card has no annual fee. |

The Chase Freedom Unlimited® Card offers a $200 bonus after spending $500 on purchases in your first 3 months from account opening. Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers. In addition, you can earn: • 6.5% cash back on travel purchased through Chase TravelSM, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase TravelSM, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases. There is no minimum to redeem for cash back & your cash back rewards do not expire as long as your account is open. This card comes with no annual fee and you'll get a free credit score that is updated weekly with Credit JourneySM. Member FDIC |

The Southwest Rapid Rewards® Plus Credit Card offers 50,000 bonus points after you spend $1,000 on purchases in the first 3 months from account opening. You'll also earn 3,000 bonus points after your Cardmember anniversary each year. You'll earn: • Earn 2X points on Southwest® purchases. • Earn 2X points on local transit and commuting, including rideshare. • Earn 2X points on internet, cable, phone services, and select streaming. You're able to redeem your your points for flights, hotel stays, gift cards, access to events & more! This card does carry a $69 annual fee. |

The Southwest Rapid Rewards® Premier Credit Card offers 50,000 bonus points after you spend $1,000 on purchases in the first 3 months from account opening. In addition, you'll earn 6,000 bonus points after your Cardmember anniversary each year. You'll earn: • Earn 3X points on Southwest purchases. • Earn 2X points on local transit and commuting, including rideshare. • Earn 2X points on internet, cable, phone services, and select streaming. You're able to redeem your points for flights, hotel stays, gift cards, access to events and more. This card does carry a $99 annual fee, but there are no foreign transaction fee. |

The United Explorer Card offers 60,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open. You'll earn: • 2x miles on United® purchases, dining, and hotel stays. • 1x mile on all other purchases Perks of this card include: • Enjoy priority boarding privileges and visit the United Club with 2 one-time passes each year for your anniversary • Free first checked bag - a savings of up to $160 per roundtrip. Terms Apply. • Up to $120 Global Entry, TSA PreCheck or NEXUS fee credit • 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Explorer Card There is a $0 introductory annual fee for the first year, then $95. Member FDIC |

The IHG One Rewards Traveler Credit Card offers 80,000 Bonus Points after spending $2,000 on purchases within the first 3 months of account opening. You'll earn: • Up to 17 total points per $1 spent when you stay at IHG Hotels & Resorts • 3 points per $1 spent on purchases on monthly bills, at gas stations, and restaurants. • 2 points per $1 spent on all other purchases This card has no annual fee or foreign transaction fees. Member FDIC |

The Southwest Rapid Rewards® Priority Credit Card offers 50,000 bonus points after you spend $1,000 on purchases in the first 3 months from account opening. In addition, you'll earn 7,500 bonus points after your Cardmember anniversary each year. You'll earn: • Earn 3X points on Southwest® purchases. • Earn 2X points on local transit and commuting, including rideshare. • Earn 2X points on internet, cable, phone services, and select streaming. Some perks include $75 Southwest travel credit each year., receiving 4 Upgraded Boardings per year when available, savings of 25% back on in-flight drinks and WiFi, and more! This card carries a $149 annual fee and no foreign transaction fees. |

The British Airways Visa Signature® Card offers 75,000 Avios after you spend $5,000 on purchases within the first three months of account opening. You'll earn: • 3 Avios per $1 spent on purchases with British Airways, Aer Lingus, Iberia, and LEVEL. • 2 Avios per $1 spent on hotel accommodations when purchased directly with the hotel. • 1 Avios per $1 spent on all other purchases. This card comes with a $95 annual fee and no foreign transaction fees. You'll be able to get 10% off British Airways flights starting in the US when you book through the website provided in your welcome materials. In addition, every calendar year you make $30,000 in purchases on your British Airways Visa card, you'll earn a Travel Together Ticket good for two years. |

The Marriott Bonvoy Boundless® Credit Card offers 5 Free Nights (each night valued up to 50,000 points) after spending $5,000 on eligible purchases within 3 months of account opening. You'll earn: • Up to 17X total points per $1 spent at over 7,000 hotels participating in Marriott Bonvoy • 3X points per $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. • 2X points for every $1 spent on all other purchase • 1 Elite Night Credit towards Elite Status for every $5,000 you spend. You gain an automatic Silver Elite Status each account anniversary year. Path to Gold Status when you spend $35,000 on purchases each account year. You'll receive 15 Elite Night Credits each calendar year & an additional Free Night Award (valued up to 35,000 points) every year after account anniversary. This card does carry a $95 fee; there are no foreign transaction fees. |

Business Credit Cards

The Ink Business Unlimited® Credit Card offers $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. You'll earn an unlimited 1.5% cash back on every purchase made for your business and you'll receive employee cards at no additional cost. This card carries no annual fee. |

The Ink Business Cash® Credit Card offers $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening. You'll earn: • 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year • 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year • 1% cash back on all other card purchases with no limit to the amount you can earn. This card comes with no annual fee. You'll be able to take advantage of employee cards at no additional cost. |

The Ink Business Preferred® Credit Card offers 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $900 cash back or $1,125 toward travel when redeemed through Chase TravelSM. You'll earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year; 1 point per $1 on all other purchases - with no limit to the amount you can earn. Furthermore, points are worth 25% more when you redeem for travel through Chase TravelSM. This card does come with a $95 annual fee but does not have any foreign transaction fees. |

The Southwest® Rapid Rewards® Premier Business Credit Card offers 60,000 points after you spend $3,000 on purchases in the first 3 months from account opening. You'll earn • Earn 3X points on Southwest Airlines purchases. • Earn 2X points on Rapid Rewards hotel and car partners. • Earn 2X points on rideshare. • 1 point per $1 spent on all other purchases. This card does carry a $99 annual fee and there are no foreign transaction fees. Member FDIC |

The Southwest® Rapid Rewards® Performance Business Credit Card offers 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening. This card earns • Earn 4X points on Southwest purchases. • Earn 3X points on Rapid Rewards hotel and car partners. • Earn 2X points on rideshare. • Earn 2X points on social media and search engine advertising, internet, cable, and phone services and 1X points on all other purchases. In addition, you can score 9,000 bonus points after your Cardmember anniversary, get 4 upgraded boarding passes per year, and more! Member FDIC |

The United? Business Card offers 75,000 bonus miles after you spend $5,000 on purchases in the first 3 months your account is open. You can also receive 5,000-mile better-together anniversary bonus when you have the United Business Card and a personal United credit card. You'll earn: • 2x miles on United® purchases, dining including eligible delivery services, at gas stations, office supply stores, and on local transit and commuting. • 1x mile on all other purchases. The card does carry a $99 annual fee ($0 intro annual fee for the first year, then $99). You're able to save up to $160 per round-trip with a free checked bag (terms apply). In addition, you can enjoy priority boarding privileges and have the opportunity for two one-time United ClubSM passes each year — Over $100 in value per year. Also, enjoy $100 annual United travel credit after 7 United flight purchases of $100 or more. Member FDIC |

Bottom Line

Even though Chase has thousands of convenient locations and ATMs, you may have trouble finding one. In order to help those readers out, I’ve put together a guide on How to Find a Chase Branch or ATM.

Just follow the steps above so you can head to your neighborhood Chase bank. If you don’t have a bank account, head to our full list of Chase Coupons to qualify for new bank account bonuses for a detailed review of the best chase accounts.

Leave a Reply