Here you will always find an updated list of Ally Bank promotions, bonuses, and offers.

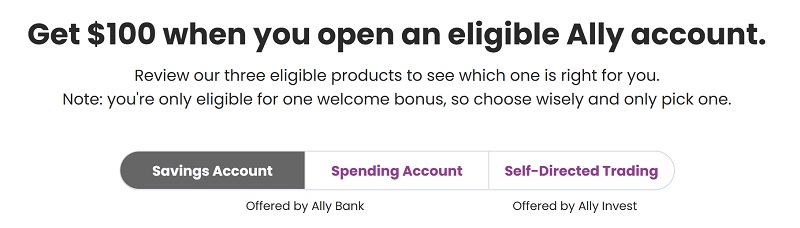

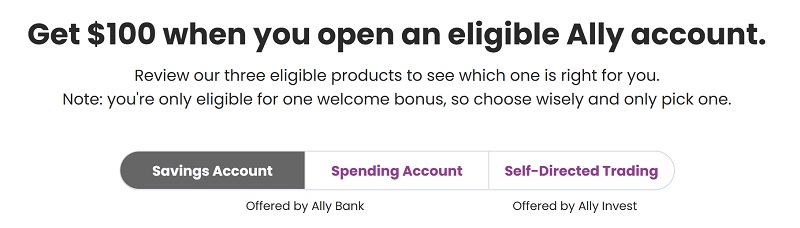

Update 7/11/25: There’s currently a $200 checking bonus valid through 8/7/25. Ally Bank is offering a $100 bonus when you open an eligible Ally Bank account (checking, savings or self-directed trading). Valid through 12/31/25.

About Ally Bank

Ally Bank has been in existence for 100 years but has since evolved and expanded nationwide by converting to an online bank. However, being an online bank does have its limitations.

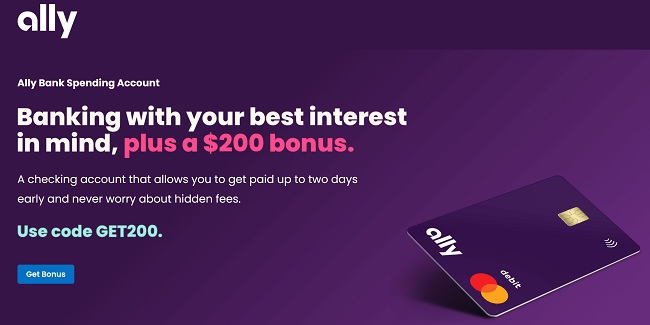

Ally Bank $200 Checking Bonus

Earn a $200 bonus when you open a Ally Bank Spending Account and meet the requirements.

- What you’ll get: $200 bonus

- Account Type: Ally Spending Account

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Opening Deposit: None

- Credit Card Funding: None

- Direct Deposit Requirement: Yes (see what works)

- Monthly Fee: None

- Household Limit: Unknown

- Closing Account Fee: Unknown

(Expires 08/07/2025)

How To Earn Bonus

- Open your first Spending Account. Use code GET200 by August 7, 2025. Add money to your account within 30 days of opening or it will close.

- Set up qualifying direct deposits of at least $2,000 a month for three consecutive months. Your first monthly qualifying direct deposit(s) totaling at least $2,000 must post to your Spending Account within 60 days of when you open the account.

- Get your $200. Ally Bank will pay your bonus within 30 days of you making the third consecutive monthly qualifying direct deposit(s). Make sure to keep your Spending Account open and in good standing in order to receive it.

- New Customers (who do not have, nor ever had, an Ally Bank Spending Account) can get a cash bonus of $200 for opening a new Ally Bank Spending Account using offer code Get200 and setting up a Qualifying Direct Deposit totaling at least $2,000 per month for three months. You have some extra time for your first month to get everything setup –Qualifying Direct Deposit(s) totaling at least $2,000 must post within 60 days from when you open your new Spending Account. Here are the basic steps to qualify, which we’ll cover in more detail below.

- 1. For a limited time, no later than 8/7/25 (we may shorten this timeframe without notice), open your first Ally Bank Spending Account using offer code Get200 where indicated in the online account application. Remember! You must fund your account with any amount within 30 days, otherwise the account will automatically close. (Note: your initial funding does not need to be your Qualifying Direct Deposit (and may need to be from another source due to timing.)

- 2. Set up a Qualifying Direct Deposit (QDD) totaling at least $2,000 per month for three consecutive months to be deposited into your new Spending Account. Your first month of QDD transaction(s) totaling at least $2,000 must post to your Spending Account within 60 days from when you open your new Spending Account.

- 3. Your cash bonus will be paid into your Spending Account within 30 days after you reach the third consecutive monthly $2,000 QDD minimum. To be paid, make sure you keep your Spending Account open and in Good Standing through the payout.

- This offer is available to New Customers who do not have an existing Ally Bank Spending account, nor have they ever had an Ally Bank Spending Account. Above lists the basic steps for you to qualify, with additional definitions and essential details below – please take a few minutes to read through all of it! And save/print/ bookmark/screenshot this page in case you need to refer back to this info.

Ally Bank $100 Checking Bonus

Earn a $100 bonus when you open a new Ally Bank Spending account and complete qualifying activities.

How to earn it:

- Enroll by 12/31/2025 and open a new, eligible Ally Bank Spending Account within 30 days of enrollment and fund within 30 days of opening your new account.

- Set up and receive a qualifying direct deposit within 60 days of account opening.

- Your $100 welcome bonus will be deposited within 30 days of receiving your qualifying direct deposit.

(Expires 12/31/2025)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

Ally Bank $100 Savings Bonus

Ally Bank is currently offering a $100 bonus when you open an Ally Bank Savings account.

How to earn it:

- Enroll and open a new Ally Bank Savings Account by 12/31/2025.

- Open a new Ally Bank Savings Account within 30 days of enrollment.

- Set up (within your new account) and start a qualifying monthly automated recurring transfer within 30 days of account opening.

- Complete at least 3 back-to-back monthly automated recurring transfers.

- Your $100 welcome bonus will be deposited within 30 days of receiving your 3rd recurring transfer.

(Expires 12/31/2025)

Ally Bank $100 Self-Directed Trading Bonus

Earn a $100 bonus when you open a new Ally Invest Self-Directed Trading account and complete qualifying activities.

How to earn it:

- Enroll by 12/31/2025 and open a new Ally Invest Self-Directed Trading account within 30 days of enrollment.

- Transfer a minimum of $1,000 within 60 days of opening your account. Note: you can make multiple transfers to reach the minimum requirement of $1,000.

- Your $100 welcome bonus will be deposited within 30 days of your account reaching $1,000.

(Expires 12/31/2025)

| J.P. Morgan Self-Directed Investing (Up to $700 Cash) | TradeStation ($150 Cash) |

| M1 High-Yield Cash Account (4.00% APY) | E*TRADE (Up to $6,000 Cash) |

| WeBull (Free Stocks) | |

Ally Bank $250 Checking Bonus (Ally Auto Customers)

Earn a $250 bonus when you open a Ally Bank Spending Account and meet the requirements.

- What you’ll get: $250 bonus

- Account Type: Ally Spending Account

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Opening Deposit: None

- Credit Card Funding: None

- Direct Deposit Requirement: Yes (see what works)

- Monthly Fee: None

- Household Limit: Unknown

- Closing Account Fee: Unknown

(Expires 12/31/2023)

How To Earn Bonus

- Open a new Ally Bank Spending Account or Savings Account by 12/31/23, with offer code ALLYAUTO1, and fund your new account within 30 days. You must be an Ally Auto customer at the time of account opening.

- Note: On the initial step of the application, be sure to select I’m not an existing Ally Bank customer.

- Set up and receive at least 1 qualifying direct deposit within 60 days of opening your new account.

- Keep your account open and in good standing and we’ll deposit your $250 within 30 days of receiving your first direct deposit.

- No minimum balance is required to open an Ally Bank Spending or Savings Account. Annual Percentage Yield (APY) is subject to change, and is accurate as of 11/10/2023. Fees may reduce earnings.

Ally Bank Up To $500 Bonus + 2.25% APY Online Savings Account (Expired)

Earn up to $500 bonus with Ally Bank Online Savings Account plus 2.25% APY.

- Get things started by opening an account with offer code GETPAID by November 21, 2022.

- Move at least $1,000 from another financial institution to a new or existing eligible Ally Bank account by November 31, 2022. Remember, transfers can take up to three business days.

- Your new money must remain in your eligible Ally Bank account through January 15, 2023. Keep in mind, any withdrawals made during this time may reduce your bonus.

- Get a 1% bonus on the money you moved, up to $500 by February 15, 2023

- Open an Online Savings account from Ally Bank.

- Maintain any balance amount and earn the 2.25% APY rate.

| Balance Requirement | APY Rate |

| $0.01+ | 2.25% APY |

- Clients can deposit checks remotely via Ally eCheck Deposit

- Interest compounds daily (great for accounts with large balances)

- Deposits are insured by the FDIC

- Allows transfers between other Ally Bank accounts and external accounts

- Transfers can be scheduled a year in advance

- Six transactions per statement cycle as required by federal law. Clients that make more than six transactions incur a $10 fee per additional occurrence.

- Interest is compounded daily

- FDIC insured up to $250,000

- No minimum to open

- Earn 2.25% APY rate on any balance

Up To $3,000 Ally Invest Bonus (Expired)

When you fund your Ally Invest account, you can earn up to a $3,000 bonus as well as free trading.

- Account Type: Ally Invest

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Opening Deposit: Unknown

- Credit Card Funding: None

- Direct Deposit Requirement: Optional

- Monthly Fee: None

- Household Limit: Unknown

- Closing Account Fee: Unknown

(Expired)

How To Earn Up To $3,000 Bonus and Free Trades

- Cash Bonus:

- Funding – Accounts must be opened by the expiration date and funded within 60 days of account opening.

- The qualifying deposit to open the new account must be from outside Ally Invest.

- The new account must be funded with a minimum qualifying deposit of $10,000 or more to receive the Minimum Cash Bonus

- The minimum qualifying funds to receive bonus offer must remain in the account (minus any trading losses) for a minimum of 90 days from the date of funding.

- Accounts will receive the specified credit, depending on the initial deposit amount, deposited into the account within ten (10) days of meeting the qualifying requirements.

- Once the account is credited, the bonus and initial qualifying deposit is not available for withdrawal for 300 days after the requirements have been met.

- If the qualifying deposit(s) are removed the bonus payout may be revoked.

- See the table below for the deposit required for each bonus amount.

| Bonus Amount | Deposit or Transfer Amount |

| $3,000 | $2M+ |

| $2,000 | $1M – $1.99M |

| $1,200 | $500k – $999.9k |

| $600 | $250k – $499.9k |

| $300 | $100k – $249.9k |

| $250 | $25k – $99.9k |

| $100 | $10k – $24.9k |

- Commission-Free Trades:

- $0 commissions- They offer commission free trading on all U.S exchange-listed stock, ETF, and option trades.

- Competitive options pricing- They also lowered our fee for option trades to just $0.50 per contract.

- $150 Transfer Fee Credit:

- Must complete a first-time ACATS account transfer of $2,500 or more to receive a Transfer Fee Credit of up $150 to cover the outgoing transfer fee from your current brokerage firm.

- ACAT forms must be received within 15 days of opening new account.

- Credit will be deposited to your account within 30 days of receipt of evidence of charge.

- This transfer reimbursement offer does not apply to Termination Fees or Maintenance Fees.

- Not valid for any retirement or ERISA qualified accounts.

- Offer is not transferable.

- Open to US residents only.

- Excludes current Ally Invest Securities, LLC account holders.

- Excludes former Ally Invest Securities, LLC (formerly TradeKing Securities LLC) account holders who have closed their accounts within the past 90 days.

Ally Bank Customers: Get $100 or $250 Bonus w/ Ally Invest Account (Targeted)

Get $100 or $250 Bonus w/ Ally Invest Account (Targeted)

Ally Bank is targeting certain customers with a chance to earn $100 or $250 Bonus w/ Ally Invest Account.

Editor’s Note: Keep in mind that there is no direct link to this targeted offer. To take advantage of this promotion, be sure to check your email for <subject: Limited Time: Get $250 for opening an Ally Invest account>

- Account Type: Ally Invest

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Opening Deposit: $500

- Credit Card Funding: None

- Direct Deposit Requirement: Optional

- Monthly Fee: None

- Household Limit: Unknown

- Closing Account Fee: Unknown

How To Earn $100 or $250 Bonus

- To participate in this cash bonus offer, click here to access the Ally Invest online application. You must open your eligible account between 2/23/2022 and 3/24/2022 AND deposit a minimum of $500 or more by 4/8/2022.

- Keep your new Ally Invest account open and in good standing for us to add your bonus to your account. We’ll pay your bonus by 5/8/2022.

- This unique offer is only available to select Ally Bank and Auto customers. You are only eligible for this bonus if you received the email offer. We’re all about playing fair, so if we believe you’re trying to game or abuse this offer, you won’t be allowed to participate in this offer or any future offers.

Compare to Other Banks

- Ally Bank vs Bank of America

- Ally Bank vs Chase

- Ally Bank vs Wealthfront

- Ally Bank vs Capital One

- Ally Bank vs Marcus by Goldman Sachs

- Ally Bank vs Axos Bank

- Ally Bank vs CIT Bank

- Ally Bank vs Discover Bank

- TD Bank vs Ally Bank

|

|

Bottom Line

Ally Bank understands you have needs and they have solutions! Therefore trade and invest how you want with access to a variety of investment choices. Furthermore, you can select from equities, bonds & CDs, options, non-proprietary mutual funds, forex trading and more to diversify your portfolio. Once you become their client, you can enjoy fair, straightforward pricing. No hidden fees or complicated pricing structures!

While Ally Bank is offering an incredible rate on their Online Savings Account, I recommend comparing it with some from our full list of Bank Rates and CD Rates.

Compare Ally Bank Promotions to other banking offers from institutions like Chase Bank, Huntington Bank, HSBC, Discover Bank, TD Bank, Bank of America, CIT Bank, & Citi.

With their online savings account, you can enjoy earning a higher rate than traditional savings accounts, you can deposit checks remotely with Ally eCheck Deposit, grow your money faster with interest compounded daily, and FDIC insured up to $250K. You get the service you need when you need it.

Make sure you check out the promotions and choose the right account for you. If you want to check up on the internet’s most complete list of Brokerage Promotions and Best Bank Rates, then keep coming back to HMB for more!

Check back here to always find an updated list of Ally Bank promotions.*

Helpful Tips