Take advantage of M&T Bank promotions, bonuses, and offers here!

Update 6/11/25: The $350 checking bonus has been extended through 8/30/25. The $200 checking bonus has been extended through 8/31/25. The up to $1500 business checking bonus is good through 6/30/25.

Editor’s Note: There is also a referral program whereas you earn $50 per referral for personal and business checking. Feel free to leave a comment below with your info to refer our readers.

About M&T Bank Promotions

Established in 1856 and headquartered in Buffalo, New York, M&T Bank has been serving its communities through a wide variety of account features and services. They are a subsidiary of M&T Bank Corporation and M&T Bank has grown to over 800 locations.

M&T Bank has branches in the following states: Connecticut, District of Columbia, Delaware, Florida, Massachusetts, Maryland, New Jersey, New York, Pennsylvania, Virginia, and West Virginia.

M&T Bank $350 Checking Bonus *No Direct Deposit Required*

- What you’ll get: $350 bonus

- Account Type: MyChoice Premium Checking

- Availability: CT, DC, DE, MD, NJ, NY, PA, VA, WV (Bank Locator)

- Direct Deposit Requirement: No

- Credit Inquiry: Soft Pull

- ChexSystem: Yes

- Credit Card Funding: Up to $250

- Monthly Fees: $0 to $24.95. Waivable

- Early Account Termination Fee: $50, if closed within 180 days

- Household limit: None listed

(Expires 08/30/2025)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | |

How To Earn Bonus

- Open a new M&T MyChoice Premium Checking account using the promo code (try CA or TK).

- Set up qualifying direct deposits, totaling at least $1,000 within 90 days of account opening.

- Earn your $350 cash bonus. Your cash bonus will be credited to your account within 90 days of all requirements being met.

- To receive the Direct Deposit Bonus, open a new MyChoice Premium Checking account between 6/1/2025 and 8/30/2025 and make at least $1,000 in qualifying direct deposits within 90 days of account opening.

- Qualifying direct deposits include recurring electronic deposits of payroll, pension or Social Security.

- Person-to-person, bank or other electronic money transfers, such as those made through internet payment services, do not qualify.

- The bonus will be credited to your account within 90 days of all requirements being met.

- Bonus offers are not available to anyone that has received a cash bonus credited to a personal M&T checking account within the last 12 months (Refer Friends Program is excluded from this 12-month period), or employees of M&T Bank or any of its affiliates.

- Only the primary signer on the new checking account may be eligible for the Bonus(es).

- The promo code is required at account opening to qualify for the bonus.

- Your new M&T MyChoice Premium checking account must still be open when we seek to credit the bonus.

- Only one bonus will be awarded per customer, regardless of the number of accounts opened.

- A $50 early close-out fee applies if the account is closed within 180 days of opening.

- Bonus offers may vary by product and region, are not transferable and are reportable for tax purposes.

M&T Bank $200 Checking Bonus

Residents can earn up to a $200 bonus when you open a new checking account and meet the qualifying requirements.

- What you’ll get: $200 bonus

- Account Type: EZChoice Checking, MyChoice Premium, MyChoice Plus Checking

- Availability: CT, DC, DE, MD, NJ, NY, PA, VA & WV

- Direct Deposit Requirement: Yes, $500+ (see what works)

- Credit Inquiry: Soft Pull

- ChexSystem: Yes

- Credit Card Funding: Up to $250

- Monthly Fees: $0 to $24.95. Waivable

- Early Account Termination Fee: $50, if closed within 180 days

- Household limit: None

(Expires 08/31/2025)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- Open any personal M&T checking account.

- Make qualifying direct deposits totaling at least $500 within 90 days of account opening.

- Your cash bonus will be awarded within 90 days after completing the qualifying direct deposits.

- $200 bonus for MyChoice Premium Checking

- $150 bonus for MyChoice Plus Checking

- $100 bonus for EZChoice Checking

- To receive the bonus (“Bonus”) you must: open a new M&T EZChoice Checking, MyChoice Plus Checking or MyChoice Premium Checking account between 6/1/2025 and 8/31/2025 and the account must receive a total of at least $500 in qualifying direct deposits within 90 days of account opening.

- Qualifying direct deposits include recurring electronic deposits of payroll, pension or Social Security.

- Person-to-person, bank transfers or other electronic money transfers, such as those made through Internet payment services, do not qualify.

- Checking Bonus will be credited to the account within 90 days of the account receiving the required qualifying direct deposits, as long as the account is still open at the time we seek to credit the bonus, and all of the eligibility requirements are satisfied.

- Bonus offers are not available to anyone that has received a cash bonus credited to a personal M&T checking account within the last 12 months (Refer Friends Program is excluded from this 12-month period), or employees of M&T Bank or any of its affiliates.

- Only the primary signer on the new checking account may be eligible for the Bonus(es).

- The promo code is required at account opening to qualify for the bonus.

- Your new personal M&T checking account must still be open when we seek to credit the bonus.

- Only one bonus will be awarded per customer, regardless of the number of accounts opened.

- A $50 early close-out fee applies if the account is closed within 180 days of opening.

- Bonus offers may vary by product and region, are not transferable.

M&T Bank $1500 Business Checking Bonus

Earn up to $1500 when you open an M&T Tailored Business Checking account with qualifying activities.

- Bonus Amount: $1500

- Account Type: Business Checking Account

- Availability: CT, DC, DE, MD, NJ, NY, PA, VA, WV, In-Branch only

- Direct deposit required: No

- Credit Inquiry: Soft

- ChexSystems: Yes

- Credit card funding: No

- Monthly fees: $20, avoidable

- Early account termination fee: $50, if closed within 365 days

- Household limit: None listed

(Expires 06/30/2025)

| Chase Business Checking ($300 or $500 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| Axos Business Premium Savings ($375 Bonus) | Axos Bank Basic Business Checking ($400 Bonus) |

| Axos Bank Business Interest Checking ($400 Bonus) | Huntington Unlimited Plus Business Checking ($1,000 Bonus) |

| Huntington Unlimited Business Checking ($400 Bonus) | Bluevine Business Checking ($300 Bonus) |

| U.S. Bank Business Checking ( $500 or $900 Bonus) | |

How To Earn Bonus

- Open online today or visit a local M&T Bank branch to open a Tailored Business Checking account by June 30, 2025. Use promo code BD.

- Maintain an average ledger balance of at least $5,000 in the third full month after you open your account.

- Bonus amount as follow:

- $300 awarded for Average Ledger balances between $5,000-$14,999.99;

- $500 awarded for Average Ledger balances between $15,000 and $29,999.99

- $750 awarded for Average Ledger Balances between $30,000 and $99,999.99

- $1,500 awarded for Average Ledger balances of $100,000 or more.

- Enjoy your cash bonus! Your account will be credited by the end of the fourth month.

- We will credit one bonus (the “Checking Bonus”) to a new M&T Tailored Business Checking account opened between October 1, 2024 and June 30, 2025 if the Average Ledger Balance in the account is at least $5,000 in the third full calendar month after the account was opened.

- The Checking Bonus amount awarded will correspond to the Average Ledger Balance maintained in the account in the third full calendar month after account opening: $300 awarded for Average Ledger balances between $5,000-$14,999.99; $500 awarded for Average Ledger balances between $15,000 and $29,999.99; $750 awarded for Average Ledger Balances between $30,000 and $99,999.99; $1,500 awarded for Average Ledger balances of $100,000 or more. A promo code is required at account opening to be eligible for the offer.

- If the requirements are met and the Account remains open, the Checking Bonus will be credited to the Account at the end of the fourth month after the Account was opened.

- The Checking Bonus is reportable for tax purposes and may be considered taxable income.

- The Checking Bonus is not available to employees of M&T Bank or any of its affiliates or to clients who have had a non-personal M&T checking account within the previous 90 days of opening the M&T Tailored Business Checking account. Only one Checking Bonus will be awarded per TIN regardless of the number of new M&T Tailored Business Checking accounts opened.

- M&T Bank reserves the right to limit business owners with multiple businesses to one account-related bonus offer across all non-personal deposit account relationships.

- A $50 Account Closure Fee applies if the account is closed within the time period referenced in the Commercial Deposit Account Fee Schedule.

- If the M&T Tailored Business Checking account that receives the Checking Bonus is closed by the client or M&T Bank within 6 months after its opening, we will deduct the Checking Bonus at closing.

M&T Bank $50 Referral Bonus

- What you’ll get: $50 bonus for you, $50 or $150 for them.

- Account Type: Personal or business Checking

- Availability: CT, DC, DE, MD, NJ, NY, PA, VA, WV

- Direct Deposit Requirement: Yes for personal checking

- Credit Inquiry: Soft Pull

- ChexSystem: Yes

- Credit Card Funding: Up to $250

- Monthly Fees: $0-$24.95. Waivable

- Early Account Termination Fee: $50, if closed within 180 days

- Household limit: None listed

(Limited time offer)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | |

How To Earn Bonus

- M&T Bank Personal Checking $50 Referral Offer

- Receive a $50 Visa® Reward Card when your friend completes all of the following steps:

- Registers using your shared referral link

- Opens a new M&T personal checking account

- Completes one (1) or more qualifying direct deposits totaling at least $500 into the new personal checking account within 90 days of account opening*

- Qualifying direct deposits include recurring electronic deposits of payroll, pension or Social Security. Person-to-person, bank transfers or other electronic money transfers, such as those made through internet payment services, do not qualify.

- Your friend can earn a $50 Visa® Reward Card!

- M&T Bank Business Checking $50 Referral Offer

- Receive a $50 Visa® Reward Card when your friend completes all of the following steps:

- Registers using your shared referral link

- Opens a new M&T Bank business checking account

- Completes at least five (5) deposits of $500 or more into the new business checking account within 90 days of account opening – OR –

- Makes at least five (5) business debit card transactions or payments (ACH, check, wire) of $25 or more each that post to the new business checking account within 90 days of account opening

- Your friend can earn a $150 Visa® Reward Card!

- Referrer Offer: The person making the referral (Referrer) will earn a $50 Visa® Reward Card for each individual or business referred (Referred Person) to M&T Bank who registers for the offer using the Referrer’s shared personal referral link, opens a new eligible account and completes all offer requirements. A Referrer may only earn a total of $500 in referral rewards per calendar year; and referral rewards may not be rolled over. Only one Referrer may receive a Reward Card for each Referred Person who fulfills the requirements (the first Referrer whose referral link is used will be the eligible Referrer).

- Referred Person Personal Checking Account Offer: To earn a $50 Visa Reward Card, the Referred Person must register for the offer using the referral link shared by the Referrer, open a new MyWay Banking from M&T Bank®, EZChoice Checking, MyChoice Plus Checking, MyChoice Plus Checking with Interest or MyChoice Premium Checking account, and make at least $500 in qualifying direct deposits within 90 days of account opening. Qualifying direct deposits include recurring electronic deposits of payroll, pension or Social Security. Person-to-person, bank transfers or other electronic money transfers, such as those made through internet payment services, do not qualify. The Referred Person must meet all applicable M&T Bank eligibility requirements for opening the account. A $50 early close-out fee applies if the account is closed within 180 days of opening.

- Referred Person Business Checking Account Offer: To earn a $150 Visa Reward Card, the Referred Person must register for the offer using the referral link shared by the Referrer, open a new M&T Tailored Business Checking or M&T Simple Checking for Business account, and complete at least five deposits of $500 or more each into the account within 90 days of account opening, OR complete at least five business debit card transactions or other payments (ACH, check, wire) of at least $25 each that post to the account within 90 days of account opening. The Referred Person must meet all applicable M&T Bank eligibility requirements for opening the account. A $50 Account Closure Fee applies if the account is closed within the time period referenced in the Commercial Deposit Account Fee Schedule.

M&T Bank $500 Checking Bonus (Expired)

- What you’ll get: $500 bonus

- Account Type: MyChoice Premium Checking

- Availability: CT, DC, DE, MD, NJ, NY, PA, VA, WV (Bank Locator)

- Direct Deposit Requirement: Yes, $1000+ (see what works)

- Credit Inquiry: Soft Pull

- ChexSystem: Yes

- Credit Card Funding: Up to $250

- Monthly Fees: $0 to $24.95. Waivable

- Early Account Termination Fee: $50, if closed within 180 days

- Household limit: None listed

(Expires 03/31/2025)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | |

How To Earn Bonus

- Open a new MyChoice Plus Checking, MyChoice Plus Checking with Interest or MyChoice Premium Checking account by 3/31/25 using the promo code TO.

- Get $500 when you set up and receive qualifying direct deposits to your new MyChoice Plus, MyChoice Plus Checking with Interest or MyChoice Premium Checking account, totaling at least $1,000 within 90 days of account opening.

- Your cash bonus will be credited with 90 days of qualifying requirements being met.

- To receive the Direct Deposit Bonus, open a new MyChoice Plus Checking, MyChoice Plus Checking with Interest or MyChoice Premium Checking account between 1/6/25 and 2/28/25 and make at least $1,000 in qualifying direct deposits within 90 days of account opening.

- Qualifying direct deposits include recurring electronic deposits of payroll, pension or Social Security.

- Person-to-person, bank or other electronic money transfers, such as those made through internet payment services, do not qualify.

- The bonus will be credited to your account within 90 days of all requirements being met.

- The promo code is required at account opening to qualify for the bonus(es).

- Your new M&T M&T MyChoice Plus or MyChoice Premium checking account must still be open when we seek to credit the bonus(es).

- Only one Direct Deposit bonus will be awarded per customer regardless of the number of accounts opened.

- Cash bonus offers are not available to employees of M&T Bank or any of its affiliates or to customers who have already received a bonus credited to a personal M&T checking account within the last 12 months (Refer Friends Program is excluded from this 12-month period).

- Only the primary signer on the new checking account may be eligible for the Bonus(es).

- A $50 early close-out fee applies if the account is closed within 180 days of opening.

- Bonus offers may vary by product and region, are not transferable and are reportable for tax purposes.

M&T Bank $400 Checking Bonus (Expired)

- What you’ll get: $400 bonus

- Account Type: MyChoice Premium Checking

- Availability: CT, DC, DE, MD, NJ, NY, PA, VA, WV (Bank Locator)

- Direct Deposit Requirement: Yes, $1000+ (see what works)

- Credit Inquiry: Soft Pull

- ChexSystem: Yes

- Credit Card Funding: Up to $250

- Monthly Fees: $0 to $24.95. Waivable

- Early Account Termination Fee: $50, if closed within 180 days

- Household limit: None listed

(Expires 02/28/2025)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| Chase Private Client ($3,000 Bonus) | |

How To Earn Bonus

- Open a new M&T MyChoice Premium Checking account by 2/28/25 using the promo code TY.

- Set up qualifying direct deposits, totaling at least $1,000 within 90 days of account opening.

- Your cash bonus will be credited with 90 days of qualifying requirements being met.

- To receive the Direct Deposit Bonus, open a new MyChoice Premium Checking account between 7/1/24 and 8/30/24 and make at least $1,000 in qualifying direct deposits within 90 days of account opening. Qualifying direct deposits include recurring electronic deposits of payroll, pension or Social Security. Person-to-person, bank or other electronic money transfers, such as those made through internet payment services, do not qualify. The bonus will be credited to your account within 90 days of all requirements being met.

- The promo code is required at account opening to qualify for the bonus(es). Your new M&T MyChoice Premium checking account must still be open when we seek to credit the bonus. Only one Direct Deposit Bonus will be awarded per customer regardless of the number of accounts opened. Cash bonus offers are not available to employees of M&T Bank or any of its affiliates or to customers who have already received a bonus credited to a personal M&T checking account within the last 12 months (Refer Friends Program is excluded from this 12-month period). Only the primary signer on the new checking account may be eligible for the Bonus(es). A $50 early close-out fee applies if the account is closed within 180 days of opening. Bonus offers may vary by product and region, are not transferable and are reportable for tax purposes.

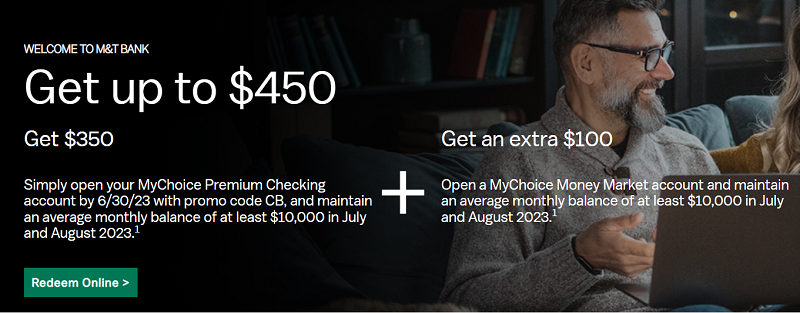

M&T Bank $450 Checking & Money Market Bonus *Expired*

Residents can earn a $450 bonus when you open a new checking & money market account and meet the qualifying requirements.

- What you’ll get: $450 bonus

- Account Type: MyChoice Premium Checking + Money Market

- Availability: CT, DC, DE, MD, NJ, NY, PA, VA & WV

- Direct Deposit Requirement: No

- Credit Inquiry: Soft Pull

- ChexSystem: Yes

- Credit Card Funding: Up to $250

- Monthly Fees: $0 to $24.95. Waivable

- Early Account Termination Fee: $50, if closed within 180 days

- Household limit: None listed

(Expires 08/25/2023)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn Bonus

- Open your MyChoice Premium Checking account. Apply online or in person to open a new M&T MyChoice Premium Checking account with promo code CC.

- Maintain an average monthly balance of at least $10,000 for the calendar months of September and October 2023.

- Earn your $350 cash bonus. Your cash bonus will be credited by 11/30/23 when you meet qualifying requirements.

- Get an extra cash bonus if you also open a MyChoice Money Market account and maintain an average monthly balance of at least $10,000 in September and October 2023.

- To receive the Premium Checking Bonus, open a new MyChoice Premium Checking account between 7/3/23 and 8/25/23 and maintain an average monthly Premium Checking account balance of at least $10,000 for the months of September and October 2023.

- To receive the Money Market Bonus, open a new MyChoice Premium Checking account and a new MyChoice Money Market account between 7/3/23 and 8/25/23 and maintain an average monthly MyChoice Money Market account balance of at least $10,000 for the months of September and October 2023. If all requirements are met, we’ll credit the bonus(es) by 11/30/23.

- Bonus offers are not available to anyone that has received a cash bonus credited to a personal M&T checking account within the last 12 months (Refer Friends Program is excluded from this 12-month period), or employees of M&T Bank or any of its affiliates. Only the primary signer on the new checking account may be eligible for the Bonus(es). The promo code is required at account opening to qualify for the bonus. Only one Checking Bonus and one Money Market Bonus will be awarded per customer, regardless of the number of accounts opened. Your new MyChoice Premium Checking account must still be open when we seek to credit the Premium Checking Bonus. Your new MyChoice Premium Checking account and MyChoice Money Market account must still be open when we seek to credit the Money Market Bonus. A $50 early close-out fee applies if the account is closed within 180 days of opening. Bonus offers may vary by product and region, are not transferable and are reportable for tax purposes.

How To Waive Monthly Fee

- EZChoice Checking: None

- MyWay Banking: $4.95 monthly fee. Maintain one or more transactions each monthly service charge cycle, such as a deposit, withdrawal, or any debit payment

- MyChoice Plus: $14.95 monthly fee. Maintain an average daily balance of $2,500 or more per monthly service charge cycle or direct deposits totaling $1,500 or more per monthly service charge cycle

- MyChoice Premium: $24.95 monthly fee. Maintain an average daily balance of $7,500 or more per monthly service charge cycle or combined daily average balances of $25,000 or more in eligible accounts

- Simple Checking for Business: $10 monthly fee.

- Tailored Business Checking: $20 monthly fee. Maintain 1 or more deposits of M&T Merchant Services Proceeds into the account or purchases made on a linked M&T Business Credit Card or M&T Business Rewards Credit Card totaled $2,000 or more in the credit card statement cycle ending in that month.

|

|

Bottom Line

If you live near an M&T Bank location, you have the opportunity to earn generous bonuses. To earn these bonuses, simply open the eligible accounts and follow the procedures and the bonuses shall be granted! M&T is more than just your neighborhood bank.

Although you can earn a generous bonus from M&T Bank, check out our list of bank promotions for more offers. With fantastic offers such as Money Market and CD rates, you are able to get the most out of your banking experience!

Compare M&T Bank Promotions with other bank bonuses from banks like Citi, Huntington, HSBC, Chase, TD, Discover Bank, Aspiration, Axos Bank, PNC Bank, BMO, SoFi, Fifth Third Bank, Bank of America, Wells Fargo, US Bank, and more!

M&T was founded on the principle of providing exceptional financial products and friendly, personalized service. Apply today and let us know how this process when for you by commenting below!