Here is a list of the Bank Promotions, Bonuses, and Offers in Indiana. As you enter the Crossroads of America, you may come by some awesome bank deals too! Indiana has plenty of Bank Bonuses throughout the state, but we’re going to mention the best ones.

When signing up for a new bank account, Bank Promotions are a common perk ranging as little as $10 bonuses to as much as $1,000 bonuses.

Occasionally you’ll run into a bank bonus worth looking into, and some not so much. Here are some local bank bonuses in The Hoosier State that are worth your time and effort signing up for. Don’t forget to check our list for ALL Bank Promotions from your respective State.

Editor’s Note: Not your state? No worries, you can click on the state(s) above to see the Top Ten Bank Promotions being offered in your state.

Best Bank Promotions in Indiana

U.S. Bank Bonuses

|

|

Huntington Bank Bonuses

• Open a Huntington Unlimited Plus Business Checking Account • Earn $1,000 bonus when you open a Huntington Unlimited Plus Business Checking account and make total deposits of at least $20,000 within 30 days of account opening. • Maintain minimum daily balance of $20,000 for 60 days after meeting deposit requirement. • The $1,000 bonus will be deposited into your account after all requirements are met. • Enjoy overdraft protection with no annual fee or deposit-to-deposit overdraft protection with no transfer fee! • Bonus Service. Choose one bonus service such as fraud tools, discounts on payroll services, or Huntington Deposit Scan® • Ideal for businesses with higher checking activity and greater cash flow needs. |

• Open a Huntington Unlimited Business Checking Account • Earn $400 bonus when you open a Huntington Unlimited Business Checking account and make total deposits of at least $5,000 within 60 days of account opening. • The $400 bonus will be deposited into your account after all requirements are met. • Get Overdraft Protection Account with no annual fee, or Deposit-to-Deposit Overdraft Protection with no transfer fee. • Enjoy unlimited transactions. And up to $10,000 in cash or currency deposits monthly in-branch or at an ATM at no charge. • Designed for businesses with higher checking activity and greater cash flow needs. • Bonus service. Choose one bonus service such as fraud tools, discounts on payroll services, or Huntington Deposit Scan®. |

Citi Promotions

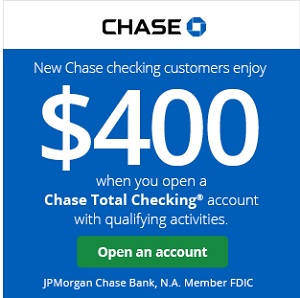

Chase Bank Bonuses

• New Chase checking customers enjoy a $125 checking account bonus when you open a Chase Secure BankingSM account with qualifying transactions. Open online or at any Chase branch. • Set up direct deposit and you may get your money up to two business days early—exclusively for Chase Secure BankingSM customers. • No minimum deposit to open an account and get started plus no overdraft fees with a Chase debit card that helps you stay within your balance. • No need to worry about overdraft fees - Chase Secure BankingSM allows you to spend only the money you have available. • Chase Secure BankingSM customers told us they save an average of more than $40 per month on fees after opening their account. • Pay bills, cash checks and send or receive money with Zelle® with a Chase Secure BankingSM account. • Chase makes it easy for you to access your money from anywhere with the Chase Mobile® app, plus thousands of ATMs and branches. • JPMorgan Chase Bank, N.A. Member FDIC. |

• Elevate your banking relationship and enjoy a bonus up to $3,000 when you open a new Chase Private Client CheckingSM account with qualifying activities. • Personalized banking made easier with premium benefits, 24/7 support and access to your banking and investment accounts in one place in the Chase Mobile® app. • Earn $1,000 when you deposit $150,000 or earn $2,000 when you deposit $250,000 or earn $3,000 when you deposit $500,000+. • Get up to a $3,000 bonus when you open or upgrade to a Chase Private Client account, a premium checking account which provides you with a dedicated banker and receive investing guidance from J.P. Morgan Wealth Management to help you reach your financial goals. • Receive personalized wealth strategies from a J.P. Morgan advisor. Your J.P. Morgan advisor gets to know you, your family and your goals to build a custom financial strategy and investment portfolio that reflects your evolving priorities. • Bank deposit accounts, such as checking and savings, may be subject to approval. Deposit products provided by JPMorgan Chase Bank, N.A. Member FDIC. |

Discover Bank Bonuses

Bank of America Bonuses

Bank of America Promotions: $400, $500, $750 for Checking, Business Bonuses (Nationwide)

Bank of America Checking Account Bonus Offer

HSBC Bonuses

|

Fifth Third Bank Promotions

BMO Harris Bank Bonuses

|

PNC Bank Bonuses

U.S. Bank Bonuses

U.S. Bank Smartly Checking Up to $450 Bonus – Ends 4/1/26

U.S. Bank Promotions for February 2026: $200, $400, $1200 Personal Checking & Business Bonuses

U.S. Bank Business Checking Bonus: $400 or $1200 Offer (Nationwide) – Ends 3/31/26

Aspiration Bonuses

Wells Fargo Bonuses

- Direct Link to Bank

- Locator

- Soft credit pull doesn’t affect your credit

CIT Bank Promotions

Ally Promotions

Axos Bank Promotions

Capital One 360 Bonuses

Regions Bank Bonuses

Regions Bank Referral Bonuses Up To $200 Bonus

Combine two Region Bank promotions to maximize your bonus amount! Many readers have reported to get the$50 personal referral bonus plus the business $150 bonus.

To get a referral link, you must:

- Send an email to referbankbonus@gmail.com and title your email “Regions Bank Referral Bonus”

- In the email, provide your full name along with the account you want to open whether it is personal checking account or business checking account.

- If you are opening a business checking account you can receive a $150 bonus. For business checking referral, title your email “Regions Bank $150 Business Referral Bonus” and then provide your full name and the name of your business in the email.

Keep in mind that when you open an account, there will be various requirements you must meet.

- Direct Link to Bank

- Locator

- Soft credit pull will not affect your credit

1st Source Bank Bonuses

- Soft credit pull doesn’t affect your credit

Allegius Credit Union Bonuses

American Airlines Federal Credit Union Bonuses

- Soft credit pull doesn’t affect your credit

Associated Bank Bonuses

- Soft credit pull doesn’t affect your credit

Banterra Bank Bonuses

BB&T Bonuses

- Soft credit pull doesn’t affect your credit

Dearborn Savings Bank Bonuses

- Soft credit pull doesn’t affect your credit

Farmers & Merchants State Bank Bonuses

- Soft credit pull doesn’t affect your credit

Fifth Third Bank Bonuses

First Merchants Bank Bonuses

General Electric Credit Union Bonuses

Jackson County Bank Bonuses

Keybank Bonuses

- Soft credit pull doesn’t affect your credit

Members Source Credit Union Bonuses

Notre Dame Federal Credit Union Bonuses

PNC Bank Bonuses

- Soft credit pull will not affect your credit

Purdue Federal Credit Union Bonuses

Republic Bank Bonuses

- Hard credit pull affects your credit

Star Financial Bank Bonuses

- Soft credit pull doesn’t affect your credit

Unify Financial Credit Union Bonuses

- Soft credit pull will not affect your credit

US Federal Credit Union Bonuses

Wesbanco Bank Bonuses

- Soft credit pull doesn’t affect your credit

|

|

|

|

Bottom Line

This is just a brief list of what we consider as the best bank bonuses in Indiana. There are many more bonuses, so you are not limited to only those listed here. It is important to learn about all important details when opening a bank account such as Hard Pull or Soft Pull, what counts as a direct deposit, or credit card funding.

At HustlerMoneyBlog.com, we strive to provide you the latest information on all bank deals and promotions. If you find another bank bonus we don’t know about, feel free to comment on any of our bank review pages and we will make sure to have the latest updates! Check out our full list of Bank Promotions!

Leave a Reply