Do you ever wish you could have saved more money at the end of every month? You’re probably wondering where all your money is going. We’re here to help you with that. All you have to do is take a look at our list of the Best Money Management Apps to help you learn how to budget, save and more!

Simple

A combo checking account and budgeting system, Simple has everything. This means it is much easier to meat your financial goals and avoid overspending. Simple will tell you what is safe to spend to avoid going over your balance. Their advice will set you up for financial success down the road. Check out our Simple Bank Promotions for more deals!

Highlights

- Categorize expenses and goals and divvy up your money accordingly

- “Safe to spend” feature lets you know where you have cash to spare

- Set up recurring bills

- Create multiple goals and see progress on the app

- Set round-up rules and save without even thinking about it

Acorns

Although not technically a budgeting app, Acorns does help you manage your money by automatically investing your spare change. All you have to do is link your most-used credit or debit card and for every purchase you make, Acorns will round up to the nearest dollar and invest the spare change. Check out our Acorns Promotions for more deals!

Highlights

- Save and invest passively

- Customize your contributions

- Add extra money to your investment account by shopping at specific stores

- Access to educational finance articles and tips

Mint

Mint is one of the best overall apps around when it comes to budgeting. Not only is this platform free, but to links to your bank accounts, credit cards, and bills, automatically updating and categorizing all your expenditures in one place. With this information, it can create budgets for you while giving your personalized suggestions to keep you on track.

Highlights

- Displays all your finances, assets, and liabilities

- Free access to credit score, plus tips on how to improve

- Payment reminders for upcoming bills

- Connects with most banks in the U.S.

- Customized tips to maximize your saving

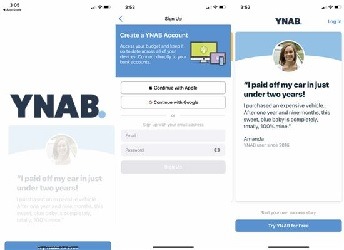

You Need a Budget

An application that needs no explanation, You Need a Budget is a platform that encourages you to meet your financial goals. With this app, you will set individual goals for the present, short-term, and long-term. They will also offer personalized advice on how to achieve these goals.

Highlights

- Real-time access to your finances across all devices

- Set multiple goals and get tips on how to achieve them

- Interactive charts help you visualize your finances

- Access to 100+ weekly live workshops for budgeting and saving

PocketGuard

With PocketGuard, you will be able to easily track your spending, create a budget, and even decrease your monthly bills. They do this by updating your transactions in real-time, helping you visualize your spending at all times. It can also automatically set up a personal budget each month so that you don’t have to do any work.

Highlights

- “In My Pocket” shows money available after bills and savings

- Creates a budget for you

- Helps you negotiate bills

- Track specific categories to avoid overspending

Dollarbird

If you’re the type that works well with calendars, Dollarbird is the app for you. It works by providing a projected balance for everyday of the month. However, instead of linking your accounts to the app, you must enter all financial information manually. Dollarbird offers a more hands-on approach to money management, so check it out.

Highlights

- Create recurring expenses (but you must confirm that they occur each month)

- Projects how much you’ll have at the end of the month based on your previous month’s spending

- Obtain projected balances for future months

- Provides a visual way of looking at your finances

Mvelopes

Mvelopes gives every dollar a “job” so that you take control of your finances and get yourself out of debt faster. They offer a few different subscription levels, but the “Basic” level provides the fundamental tools to help you learn to manage your finances

Highlights

- Sync all bank and credit card accounts

- Transactions sync automatically

- Set up unlimited “envelopes”

- Manage money while on-the-go with cloud storage of your data

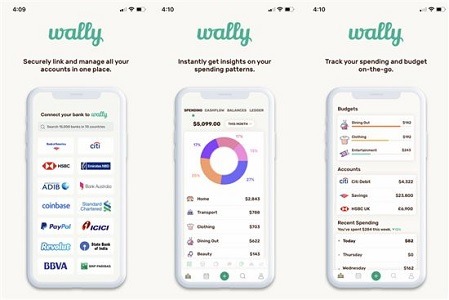

Wally

For those of you who want a simple and intuitive budgeting tool that isn’t too overwhelming with all the extra features, Wally is the app for you. They have a simple interface that will give you a full overview of your finances, including where you money goes, how much you saved, and the amount that you have left. Wally is 100% free and even works in multiple currencies.

Highlights

- Save photos of your receipts for tax purposes

- Set up Automatic recurring expenses

- Track expenses by category (or location/store)

- Group budgets, IOUs, and joint accounts

- Plan your shopping and sending with lists

Clarity Money

Clarity Money uses machine learning to break down and visualize your financial habits. Link your bank accounts and credit cards to get a full view of your expenses, see where you can cut back and create a categorized budget. If you’re often asking yourself, “What did I spend on Amazon this month?”, this is the app for you.

Highlights

- Dashboard displays all your subscriptions

- Open a high-yield savings account through Marcus by Goldman Sachs

- See visual representations of your bills and expenses

- Get free access to your credit score

- Get alerts about subscription price increases or reductions

Goodbudget

If you’re more traditional and want the paper envelope budgeting method, then Goodbudget is a great option. Just like the envelope budgeting method, you create categories and assign a budgeet to each one. Once you spend your limit for that category, that is all you are allowed to spend, unless you transfer money from another category.

Highlights

- Syncs across multiple devices

- Helps you actively plan your spending

- Track your debt payoff progress

- Set up a savings envelope for each goal

- 1 year of expense tracking (7 years if you buy the Plus membership)

Personal Capital

Personal Capital is a finance app that puts everything in one place for you to view. This includes your investments, savings, and more to give you an overview of your personal finances. They offer graphs to visualize your investments and understand how they contribute to your net worth.

Highlights

- Syncs across multiple devices

- Helps you actively plan your spending

- Track your debt payoff progress

- Set up a savings envelope for each goal

- 1 year of expense tracking (7 years if you buy the Plus membership)

|

Bottom Line

Making a decision on which money management app is the right one for you depends on your needs and what you’re comfortable with. The best one will generally be the one you can see yourself using. To help you make your decision, think about how often you want to check in, what features you want, and if you want to link your bank account. For more posts like this, check out post on how to save money and bank guides!

Leave a Reply