Here you can find the most recent BankPlus promotions, bonuses, and offers here.

Currently, residents of select states can earn bonuses from $50, $100, $110 when you open a new Checking Account.

About BankPlus Promotions

BankPlus has operated as a privately held community bank for over 100 years. Today, they stand tall as a proud, full-service regional bank. One whose employees always seek to give their customers more. More access. More technology. And more of the products and services that continually set them apart from others.

We will review the current BankPlus promotions below.

BankPlus $110 Business Checking Bonus

Currently, BankPlus is offering a $110 Business Checking Bonus when you open a new account and meet certain requirements.

- What you’ll get: $110 bonus

- Account Type: Business Checking account

- Availability: AL, LA, MS (Branch Locator)

- Direct Deposit Requirement: No

- Hard/Soft Pull: Unknown, let us know.

- ChexSystem: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: None

- Early Account Termination Fee: None listed

- Household Limit: None listed

(Limited time offer)

| Chase Business Checking ($300 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| U.S. Bank Business Checking ($350 or $800 Bonus) | Axos Bank Basic Business Checking ($400 Bonus) |

| Axos Bank Business Interest Checking ($400 Bonus) | Huntington Unlimited Plus Business Checking ($1,000 Bonus) |

| Huntington Unlimited Business Checking ($400 Bonus) | Huntington Business Checking 100 ($200 Bonus) |

| Live Oak Bank Business Savings ($300 Bonus) | |

How To Earn Bonus

- To earn the $100,

- To earn the $25 business checking cash bonus, use your BankPlus Business Visa® for 2 debit card transactions (Posted and Cleared) in month of account opening.

- To earn the additional $75 business checking bonus, use your BankPlus Business Visa® for 8 debit card transactions (Posted and Cleared) in the second month of account opening (ATM transactions are excluded)

- To earn another $10,

- Bring in your debit cards and unused checks from your current account at another financial institution. We’ll buy them from you for $10!

- To qualify to earn the full $100, you must complete the following: A. To earn the $25 business checking cash bonus, use your BankPlus Business Visa® for 2 debit card transactions (Posted and Cleared) in month of account opening. B. To earn the additional $75 business checking bonus, use your BankPlus Business Visa® for 8 debit card transactions (Posted and Cleared) in the second month of account opening (ATM transactions are excluded). Limit of one $100 bonus per business. $25 bonus and $75 bonus will be credited to the account at end of statement cycle in which transactions were posted and cleared.

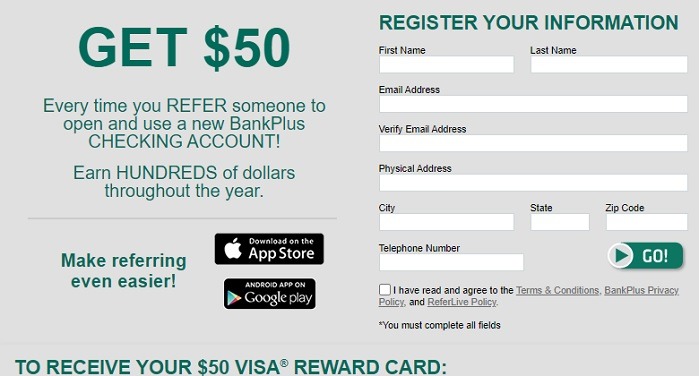

BankPlus $50 Referral Bonus

Earn a $50 bonus when you refer someone to open a new checking account.

Earn a $50 bonus with BankPlus! Residents of Alabama, Louisiana, and Mississippi can earn a $50 bonus when you refer a friend or family member to open a new Checking Account and meet the requirements.

- What you’ll get: $50 bonus

- Account Type: Checking account

- Availability: AL, LA, MS

- Direct Deposit Requirement: None

- Credit Inquiry: Unknown, let us know.

- ChexSystem: Unknown

- Credit Card Funding: Unknown

- Monthly Fees: None

- Early Account Termination Fee: None listed

- Household Limit: None listed

(Limited time offer)

Here is an alternative link to apply.

| U.S. Bank Smartly® Checking ($700 bonus) | Truist Checking ($400 bonus) |

| BMO Smart Money Checking ($250 bonus) | BMO Smart Advantage Checking ($250 bonus) |

| Bank of America ($200 bonus offer) | Chase Total Checking® ($300 bonus) |

| Fifth Third Bank Momentum® Checking ($200 bonus) | SoFi Checking and Savings ($325 bonus) |

| KeyBank Key Select Checking ($200 bonus + $100 Bonus) | KeyBank Key Smart Checking ($200 bonus) |

How To Earn Bonus

- Complete your information in the registration form above and click GO!

- Provide contact information AND a valid email address for the friends or family members you are referring OR share this offer via social media. This offer is not available to any friend or family member who already has a BankPlus checking account.

- Once your friend or family member registers, opens a new checking account, AND completes the following requirements within 60 days of account opening, you will BOTH receive a $50 Visa® Reward Card!

- Have one (1) debit card purchase, AND

- Have one (1) direct deposit (payroll or government) of at least $100, AND

- Enroll in online banking, AND

- Keep the account open and in good standing for at least 60 days

- Please allow up to 4-6 weeks for receipt of your Reward Card after completion of program requirements.

- You can receive only one new checking account opening related bonus every 12 months

- Please allow up to 4-6 weeks for receipt of your Reward Card after completion of program requirements.

- Your friend or family member will receive an email notification containing registration instructions and requirements of this offer.

- Bonuses are considered interest and will be reported on IRS Form 1099-INT (or Form 1042-S, if applicable.)

- Your direct deposit needs to be an electronic deposit of your paycheck, pension or government benefits from your employer or the government

How To Waive Monthly Fees

- ValuePlus Checking: There are no monthly service fees.

- ValuePlus Interest Checking: No service fee with $1,500 minimum daily balance, otherwise there is an $8 fee per month

- ValuePlus Student Checking: $6 monthly service fee

- Carefree Checking: $0 monthly service fee with online-only statements, otherwise a service fee of $5 per month for paper statements

- Student Checking: No monthly fee listed

- PrimePlus Checking: There are no monthly service fees.

- InvestmentPlus Checking: No monthly service fee with $1,000 minimum balance, otherwise $8 per statement cycle

- Free Business Checking: No monthly fee listed

- Business Interest Checking: Maintain a minimum balance of only $1,500 to avoid a low monthly fee of $8

- Commercial Checking: Only $15 per month service charge

- Personal Savings: No service fee when you keep a minimum balance of $100; otherwise the fee is $5 per month

- Christmas Club Savings: No monthly fee listed

- Personal Money Market: No service fee if your account balance doesn’t fall below $1,000; otherwise there is a service fee of $8 per statement cycle

|

Bottom Line

The $50 bonus offered by BankPlus are quite generous, so I would check this promotion out if it interests you. Additionally, there is a large variety of features you can access when you open an account and it is soft pull.

Feel free comment below and let us know about how it went and if you could fund your account with credit card or not. We value your feedback and will continue to keep you posted on the latest bank offers nationwide.

Compare BankPlus Promotions with other bank bonuses from banks like U.S. Bank, Citi, Huntington, Chase, TD, Discover Bank, Aspiration, Axos Bank, PNC Bank, BMO Harris, SoFi, Fifth Third Bank, Bank of America, and more!

*Check back on this page for updated BankPlus promotions, bonuses, and offers.

Leave a Reply