Citi ThankYou® Rewards isn’t as popular as alternative like Chase Ultimate Rewards and Capital One Miles. Part of the reason is because Citi ThankYou has only five point-earning credit cards, one domestic airline transfer partner and no hotel transfer partners.

However, ThankYou points are super easy to earn – thus increasing their value. And, with a few tips and tricks, you can maximize their value to be good competition with alternatives. Here’s everything you need to know about Citi ThankYou Rewards.

View the latest Citibank Promotions here and Citi credit card offers here compared to the best credit card bonuses.

Citi ThankYou Rewards Quick Facts

| Credit Cards | Citi Prestige® Credit Card Citi Premier Card Citi Rewards+? Card AT&T Access Card from Citi |

| Redemption Options | Travel via ThankYou Travel Center Statement credits & mailed checks Gift cards Shopping at retail partners Payments toward bills, mortgages or student loans Charitable donations Transfer to partner loyalty programs |

| Average Citi ThankYou Rewards Value | $0.0075 – $0.0125 Up to $0.06 |

Earning Citi ThankYou Rewards

Citi offers a variety of credit cards, but keep in mind that only a few will earn ThankYou points like we mentioned above. Here’s a list of the credit cards and their benefits:

| Credit Card | Welcome Bonus | Ongoing Rewards |

| Citi Prestige® Credit Card $495 annual fee |

50,000 points – spend: $4,000 – time: 3 months |

5x points on air travel & restaurants 3x points on hotels & cruise lines 1x points on all other purchases |

| Citi Premier Card $95 annual fee, waived first 12 months. |

60,000 points – spend: $4,000 – time: 3 months |

3x points on travel & gas stations 2x points on restaurants & entertainment 1x points on all other purchases |

| Citi Rewards+? Card* $0 annual fee |

15,000 points – spend: $1,000 – time: 3 months |

2x points on supermarkets & gas stations – (on up to $6,000 spent each year) 1x points on all other purchases Automatically rounds up to the nearest 10 points |

| AT&T Access Card from Citi* No annual fee |

10,000 points – spend: $1,000 – time: 3 months |

2x points on AT&T products & services 2x points on eligible retail & travel websites 1x points on all other purchases |

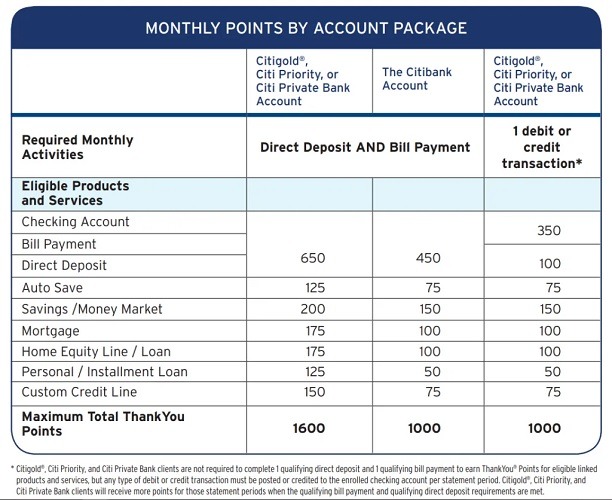

On top of earning ThankYou points using one of the credit cards above, you can also use a Citibank account. Earn points by completing one direct deposit and one bill payment, or one debit or credit transaction every month. Using both methods in conjunction can net you a large number of points very quickly.

The final method of getting points is to purchase them. However, this isn’t the most recommended method because you will be paying $0.025 per point, which is way more than they are worth. Also, they only come in 1,000 point increments.

Spending ThankYou Points

When considering redeeming your ThankYou points, keep in mind that there are two types of points. The ones you can earn with the Citi Prestige and Citi Premier are worth more, and you can transfer them to one of ThankYou Rewards many travel partners. The points you earn on Citi Rewards+ and AT&T Access from Citi aren’t worth as much, and they’re non-transferable.

Also, as long as yo hold a Citi Prestige or Citi Premier card, you can always combine your points earned from a lower-tier ThankYou card. This will allow you to transfer your lower-tier points to a partner program. Your points will not expires as long as you keep your account open, but late payments can prevent you from earning more points.

With a Citi Prestige or Citi Premier credit card, you have the power to transfer your ThankYou points to the following loyalty programs:

- Avianca LifeMiles

- Cathay Pacific Asia Miles

- EVA Air Infinity MileageLands

- Etihad Guest Miles

- Air France/KLM Flying Blue

- InterMiles

- JetBlue TrueBlue

In a majority of the time, the transfer rate to these programs are a 1:1. However, you must transfer in 1,000 point increments.

Redeem your ThankYou points through the ThankYou Travel Center for airfare, hotel stays, car rentals, cruises and other travel. Point value varies according to which credit card you have and what redemption you choose:

| Credit Card | Flights | All Other Travel |

| Citi Prestige® Credit Card | $0.0125/point ($0.01/point after 09/01/2019) |

$0.01/point |

| Citi Premier Card | $0.0125/point | $0.0125/point |

| Citi Rewards+? Card* | $0.01/point | $0.01/point |

| AT&T Access Card from Citi* | $0.01/point | $0.01/point |

| Redemption | Value Per Point |

| Statement credits | $0.01 |

| Gift cards | $0.01 |

| Bill, mortgage or student loan payment | $0.01 |

| Charitable donations | $0.01 |

| Shop with Points (Amazon or Best Buy) | $0.008 |

| ThankYou Select & Credit | $0.0075 |

| Cash (check by mail) | $0.005 |

You also have the option to share your ThankYou points with anyone that has a ThankYou Rewards account. This is a useful option if someone you know needs extra points to book a trip.

Make sure to follow these guidelines:

- You can transfer up to a maximum of 100,000 ThankYou points per calendar year.

- You can receive up to a maximum of 100,000 ThankYou points per calendar year.

- Transferred ThankYou points will expire within 90 days.

- Transferred ThankYou points cannot be transferred again to another account.

Sign on to your ThankYou points account for further details.

ThankYou Rewards Partner Airline Sweet Spots

With so many airline partners to transfer to, you have plenty of ways to maximize your ThankYou points. Despite the fact that ThankYou Rewards only has with one domestic airline partner, you have great domestic award flight options through its partnerships with international airlines.

Thanks to the extensive list of airline partners, you have a plethora of ways to maximize your ThankYou points. Even though ThankYou Rewards only partners with one domestic airline, you still have great domestic award flight options through its partnerships with international airlines.

Here are a few sweet spot airlines to consider:

| TICKET | CLASS | FROM | TO | MILES | AIRLINE |

| One-way | Economy | U.S. | U.S. | 6,500+ | United |

| TICKET | CLASS | FROM | TO | MILES | AIRLINE |

| One-way | Business | U.S. | Europe | 50,000 | Cathay Pacific |

| Roundtrip | Business | U.S. | Europe | 100,000 | Cathay Pacific |

| TICKET | CLASS | FROM | TO | MILES | AIRLINE |

| One-way | Business | New York | Casablanca | 44,000 | Royal Air Maroc |

| One-way | Business | U.S. | Europe | 50,000 | American |

| One-way | Business | U.S. | Japan | 50,000 | American |

| One-way | Business | U.S. | South Korea | 50,000 | American |

| Roundtrip | Business | U.S. | Europe | 100,000 | American |

| TICKET | CLASS | FROM | TO | MILES | AIRLINE |

| Roundtrip | Economy | U.S. | Hawaii | 35,000 | United |

| Roundtrip | Business | U.S. | Hawaii | 69,000 | United |

| One-way | First | New York | Frankfurt | 86,000 | Singapore |

| One-way | First | Los Angeles | Tokyo | 107,000 | Singapore |

| TICKET | CLASS | FROM | T0 | MILES | AIRLINE |

| One-way | Economy | U.S. | U.S. | 12,000 | Delta |

| One-way | Business | U.S. | Europe | 50,000 | Delta |

| One-way | Business | Detroit | Tokyo | 60,000 | Delta |

| One-way | Business | Auckland | U.S. | 62,500 | Air New Zealand |

| Roundtrip | First | Detroit | Tokyo | 110,000+ | ANA |

Citi Credit Card Promotions

|

Bottom Line

Despite having a lower point value, ThankYou points can be worth quite a bit if used properly. To unlock the full potential of ThankYou Rewards, we highly recommend carrying either the Citi Prestige or the Citi Premier credit card. Additionally, these cards will allow you transfer to airline partners, giving you chances to score great travel deals.

Citi ThankYou Rewards gives you the ability to earn great value out of easy-to-earn points. One of the only downsides of these points is that there aren’t many transfer partners.

Not only can you get decent transfer ratios, you can also earn points through popular credit cards.

If you’re liking our Citi ThankYou Rewards guide, be sure to share it with a friend. For more posts like this check out our list of credit card bonuses and ways to save money!

In addition, keep up to date with the latest Citibank Promotions.

Leave a Reply