Available nationwide, Ally Bank Online Savings is offering a $100 bonus + 3.50% APY Rate. Continue reading below to learn everything you need to know about Ally Bank.

Update 6/30/25: The rate has decreased to 3.50% APY from 3.60%. There is currently a $100 bonus available through 12/31/25.

Ally Bank $100 Savings Bonus

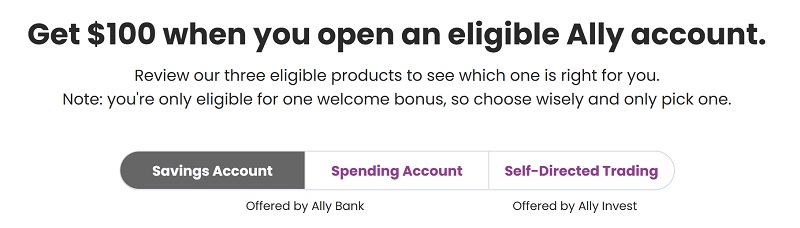

Ally Bank is currently offering a $100 bonus when you open an Ally Bank Savings account.

How to earn it:

- Enroll and open a new Ally Bank Savings Account by 12/31/2025.

- Open a new Ally Bank Savings Account within 30 days of enrollment.

- Set up (within your new account) and start a qualifying monthly automated recurring transfer within 30 days of account opening.

- Complete at least 3 back-to-back monthly automated recurring transfers.

- Your $100 welcome bonus will be deposited within 30 days of receiving your 3rd recurring transfer.

(Visit Ally Bank to learn more)

About Ally Bank Online Savings

For nearly 100 years, Ally hank has been committed to making a real difference in their customers lives. They offer award-winning online banking, rewarding credit experiences, and unmatched auto financing products.

Being an online account, they can offer one of the highest rates! The account gives you access to online banking, eStatements, mobile banking, text alerts, and so much more.

| Balance Requirement | APY Rate |

| $0.01+ | 3.50% APY |

Ally Bank Online Savings Rate

To earn Ally Bank’s competitive rate, simply open the new account. That’s all it takes and you’ll get to enjoy earning the high rate on all balances.

- Learn More at Ally Bank

- Account Type: Online Savings Account

- Interest Rate: 3.50% APY

- Minimum Balance: None

- Maximum Balance: None

- Availability: Nationwide, Online

- Credit Inquiry: Soft Pull.

- Opening Deposit: $0

- Monthly Fee: No monthly maintenance fees.

- Early Account Termination Fee: No

(Visit Ally Bank to learn more)

ACH Capabilities & Limits

| ACH Type | Speed | Daily $ Limit | Monthly $ Limit | Notes |

| Push | 1-3 days | $150,000 | $600,000 | Min $1 transfer |

| Pull | 1-3 days | $250,000 | $1,000,000 | 20 linked accounts |

Editor’s Note: Help us with the table above in the comment section if you have experience with ACH capabilities.

How to Earn Ally Bank Rate

- Open a Online Savings account from Ally Bank.

- Maintain any balance amount and earn the 3.50% APY rate.

Why You Should Sign Up For This Account

- Interest is compounded daily

- FDIC insured up to $250,000

- No minimum to open

Bottom Line

Check out Ally Bank and open a Online Savings account this amazing rate! The fact that you can earn a high rate on any balance makes this Savings Account all worthwhile.

Let us know about your experience with this bank and comment below.

For more bank offers, see the complete list of Best Bank Rates and the latest bank bonuses.

Interested in Bank Bonuses? See our favorite banks including HSBC Bank, Chase Bank, Huntington Bank, Discover Bank, TD Bank, CIT Bank, Bank of America, or Citi.

*View the latest Ally Bank Promotions here. Compare Ally Online Savings with other interest bearing accounts.*

Check back often to see the latest info on Ally Bank Account.